Feb. 14, 2019

Spring Infrastructure Capital Co., Ltd

Sumitomo Corporation

Sumitomo Mitsui Banking Corporation

Development Bank of Japan, Inc.

Establishment of Renewable Energy FundInaugural fund to be Japan’s first for investing in overseas offshore wind power projects

Sumitomo Corporation (Head Office: Chiyoda-ku, Tokyo; Representative Director, President and Chief Executive Officer: Masayuki Hyodo), Sumitomo Mitsui Banking Corporation (Head Office: Chiyoda-ku, Tokyo; President and Chief Executive Officer: Makoto Takashima; hereinafter, “SMBC”) and Development Bank of Japan Inc., (Head Office: Chiyoda-ku, Tokyo; President and Chief Executive Officer: Hajime Watanabe; hereinafter, “DBJ”), have established their first fund (hereinafter, “the Fund”) through Spring Infrastructure Capital Co., Ltd. (hereinafter, “the Company”), a fund management company jointly established by the three companies.

The Fund raises money from Japanese investors and finances and invests in offshore wind power projects overseas. The Fund will acquire UK assets held by Sumitomo Corporation as seed assets (Note 1), and this will be the first fund in Japan designed to invest in offshore wind power projects overseas. The Fund will seek to raise up to 30 billion yen.

The Company was founded in July 2018 to provide institutional investors with opportunities to invest in renewable energy assets both inside and outside Japan. The aim is to meet investors’ expectations by dispatching members experienced and knowledgeable in investment/financing in the renewable energy sector to the Company, where they will participate in running the infrastructure projects in which the Fund invests and thereby provides value to local communities. The Company will also help meet investment needs from domestic investors and contribute to building infrastructure worldwide by developing mechanisms to funnel funds back into infrastructure projects, especially renewable energy projects.

Sumitomo Corporation is actively engaged in developing and running renewable energy projects worldwide, and it now possesses 1.4GW in generation capacity. By completing the development/construction of these projects and then selling to the Fund some of the assets that have begun stable operation, Sumitomo Corporation will achieve strategic asset replacement while it works to develop more infrastructure projects with quality.

SMBC has a track record of providing more than three trillion yen in renewable energy project finance globally. As one of the top players in finance for offshore wind power generation, SMBC has financed power plants with a total capacity of more than 10GW. In this particular project, the SMBC Group will be providing the knowledge and know-how it has cultivated heretofore to facilitate smooth operation of the Fund.

DBJ will be leveraging its knowledge and investment experience in UK offshore wind power projects as it participates in managing the Company. Because the Fund will be working to provide Japanese institutional investors with opportunities to invest in offshore wind power projects and other renewable energy projects and because the Fund will be helping Sumitomo Corporation accelerate activities in renewable energy projects inside and outside Japan, DBJ has decided to supply funding through the use of “Special Investment Operations”.

(Note 1) Seed assets

Assets targeted for investment by a fund; in this instance, the Race Bank Offshore Wind Farm and the Galloper Offshore Wind Farm are envisioned as seed assets for the Fund.

<Reference>

| ■ Profile of the Company | ||

| Trade name | : | Spring Infrastructure Capital Co., Ltd |

| Address | : | 4F, Otemachi First Square East Tower 1-5-1 Otemachi, Chiyoda-ku, Tokyo |

| Representative | : | Yoichi Sakai, Representative Director, President |

| Description of business | : | Investment operations, etc. |

| Capital | : | 250 million yen |

| Date of establishment | : | July 31, 2018 |

| Shareholders | : | Sumitomo Corporation 51% Sumitomo Mitsui Banking Corporation 24.5% Development Bank of Japan, Inc. 24.5% |

| ■Profile of the Fund (tentative) | ||

| Total amount of funds | Up to about 30 billion yen(tentative) | |

| General partner | Spring Infrastructure Capital Co., Ltd | |

| Limited partners | Sumitomo Corporation Sumitomo Mitsui Banking Corporation Development Bank of Japan Inc. Others |

|

■Diagram of Fund scheme

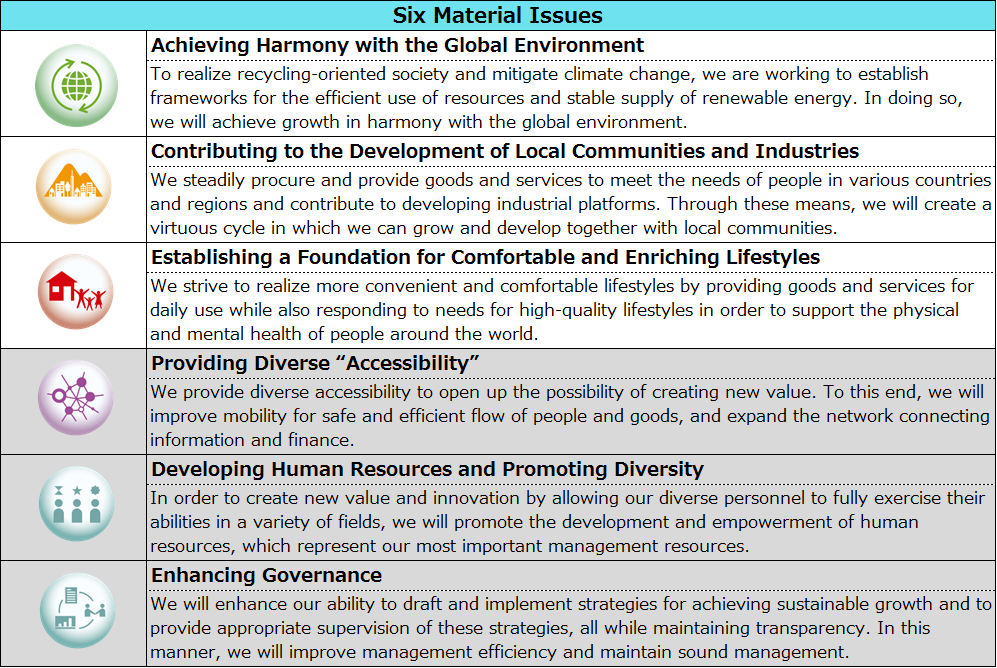

■Sumitomo Corporation’s Material Issues

Sumitomo Corporation Group positions “Six Material Issues to Achieve Sustainable Growth with Society” as an important factor in developing business strategies and in the decision-making process for individual businesses. Going forward, we will pursue sustainable growth by resolving these issues through our business activities. This project especially contributes to “Achieving Harmony with the Global Environment”, “the Development of Local Communities and Industries” and “Establishing a Foundation for Comfortable and Enriching Lifestyles”.

- Inquiries

- Corporate Communications Department, Sumitomo Corporation

- News Release Contact Form