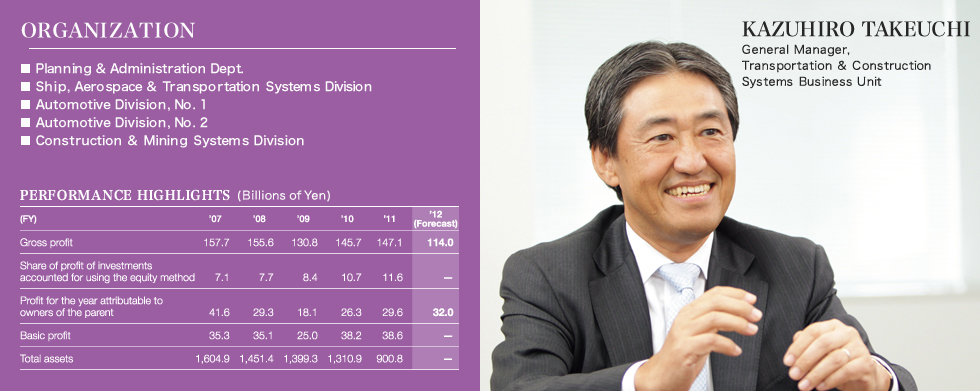

Transportation & Construction Systems

Business Unit Overview

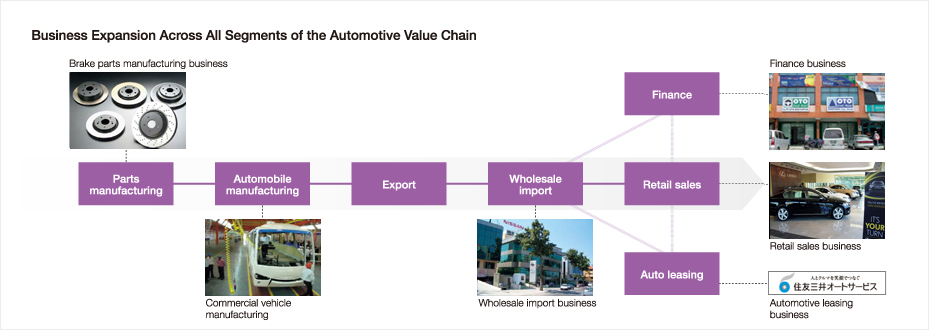

We are expanding our upstream, midstream and downstream operations in the fields of automobiles, ships, aircraft, railway and other transportation systems as well as construction equipment. In the automotive field, our growing global value chain covers manufacturing, wholesale, retail, leasing and retail finance services. In the ship, aerospace and railcar field, we are the only trading company that holds an equity stake in a shipbuilding company. We are also engaged in the ship-owning and operating business. In aircraft-related operations, we are involved in international trading in civil aircraft, engines and related equipment, and imports of defense-related equipment.

Furthermore, we have strengths in export of railways, public transportation systems and railcars. In the construction equipment field, we have the highest transaction volume of construction equipment among trading companies, with construction equipment sales handled through our global network. Our value chain also covers rental operations, and we are expanding comprehensive mining equipment services. We are also developing the agricultural machinery sales business.

Business Field Overview: Actions for Target Achievement

AUTOMOTIVE FIELD

Business Environment

Looking ahead, we anticipate sustained growth in demand in emerging countries as motorization takes hold. In developed countries with mature markets, we foresee new growth opportunities arising due to business model innovation and strategic alliances.

Strengths and Strategies

In the automotive leasing, we hold Sumitomo Mitsui Auto Service Company, Limited, which has become the largest group in Japan's auto leasing industry. We also aim to promote strategic alliances with the Hitachi Capital Group.

In finance businesses for automobiles and motorcycles in Indonesia, we will build on our strengths by shifting our focus on further improvements in quality, while expanding to peripheral businesses based on our strong customer base and operating infrastructure.

In manufacturing, KIRIU Corporation, an automobile parts manufacturing subsidiary, will install additional production lines at plants in China, India, and Mexico, as well as Thailand, in response to the rising demand for parts from automakers.

In addition, we will concentrate on automobile manufacturing operations in emerging countries. For example, we aim to further expand the manufacturing of commercial vehicles in India by strengthening our alliance with Isuzu Motors Limited.

Furthermore, efforts will be made to strengthen automotive sales operations in Libya, Iraq, Myanmar and other emerging ountries where rapid economic development is anticipated going forward.

Actions for Target Achievement

We have established a company for production of vehicles in Mexico as a joint venture with Mazda Motor Corporation, and have begun construction of a new automobile assembly plant. This plant will supply compact cars with low fuel consumption, a category which is in increasingly strong demand, to all regions in North America, as well as Latin America.

Commercial vehicle manufacturing in India

Commercial vehicle manufacturing in India

SHIP, AEROSPACE & TRANSPORTATION SYSTEMS FIELD

Business Environment

Although marine freight conditions have weakened, there are growing opportunities for purchasing prime ship assets given progress on the development of environmentally friendly, energy-efficient ships. We also expect increased demand for civil aircraft over the medium and long terms, as well as burgeoning global demand for railways due to the ongoing shift in transportation mode.

Strengths and Strategies

In the ship business, we aim to maintain and enhance a highly profitable asset portfolio. This will be achieved by further bolstering our shipowning and operating business, and by upgrading trading activities based on our strengths, namely our expansive customer base and operating infrastructure, including our investment in Oshima Shipbuilding Co., Ltd. In the aircraft field, we will work to build a new business model utilizing our finance capabilities and broad network of business connections developed through trading activities.

In the railcar business, we aim to win large orders in North America and Southeast Asia based on expertise amassed in the construction of urban railway systems.

Actions for Target Achievement

Together with Nippon Sharyo, Ltd., we have won an order for 50 gallery-type passenger railcars from Virginia Railway Express, and have delivered more than 1,000 railcars to North America on a cumulative basis, including this order.

Gallery-type passenger railcar we delivered to Northeastern Illinois Railway Services Inc. in the U.S.

Gallery-type passenger railcar we delivered to Northeastern Illinois Railway Services Inc. in the U.S.

CONSTRUCTION EQUIPMENT FIELD

Business Environment

Demand for construction equipment is projected to increase in emerging countries due to surging infrastructure development. In resource-rich countries, increased demand is anticipated for mining equipment on the back of active development of mineral resources.

Strengths and Strategies

Our construction equipment business in Canada has become our greatest earnings driver, thanks to diversification and active investment primarily in mine operations in past years.

As a result of efforts to bolster the operating infrastructure of our sales subsidiaries in China and Russia, they have become the next largest earnings drivers after Canada. Furthermore, we are working to expand our earnings base in emerging countries by developing business in the Middle East and Asia. In Mongolia, Russia and other countries, we aim to develop a comprehensive mining equipment business closely tied to customers. In developed countries, where renting is becoming more prominent than ownership, we aim to promote the construction equipment rental business.

Actions for Target Achievement

In China, we have converted distributors in Changchun, Xi'an, Wuhan, Chengdu, and Hangzhou into our subsidiaries, while winning orders for large mining equipment for overseas mines being developed by Chinese companies.

In Kemerovo Oblast, Russia, where coal development is proceeding apace, our sales subsidiary has opened the Kuzbass Office.

Komatsu mining machinery operating in the Kuzbass, or the Kuznetsk Basin, Russia's largest coal mining area

Komatsu mining machinery operating in the Kuzbass, or the Kuznetsk Basin, Russia's largest coal mining area