Special Feature 1 Earnings Expansion:Providing new value while staying attuned to customer needs and addressing changes

Expanding Shale Gas and Oil Development

Fossil fuels found in a natural state that is more difficult to develop and recover than conventional resources are classified as “unconventional resources.” One example is oil and natural gas trapped directly inside solid layers of rock beneath the earth's surface. Among these resources, shale gas and oil, which are found in the thin and brittle shale layer, have attracted considerable attention mainly in North America. Although the existence of shale resources have long been known, commercial production was not feasible given the difficulty in developing and recovering these resources. However, in the early 2000s, the technologies for hydraulic fracturing and horizontal drilling were successfully established in the U.S.,and it significantly reduced development costs. As a result, commercial shale gas production commenced on a full scale from around 2006. Thereafter, from 2010, the focus of development has shifted to shale oil due to persistently high crude oil prices.

These shale gas and oil wells involve an extended length of horizontal drilling that require oil country tubular goods (OCTG) with a smaller diameter than conventional products. For this reason, demand for small-diameter OCTG has increased sharply since 2007.

THE NATURAL GAS IN THE U.S.

Strengthening the Seamless Pipe Manufacturing Business

Under such circumstances, in October 2011, Sumitomo Corporation participated in the project of establishing a small-diameter seamless pipe mill in the U.S.

This pipe mill is located in close proximity to the Marcellus Shale in Pennsylvania, one of the most active shale development regions. In addition, the location is adjacent to the premises of V&M Star LP, an Ohio-based firm acquired by Sumitomo Corporation together with Vallourec S.A., a major French pipe producer, in 2002. Sharing raw materials with V&M Star will facilitate efficient production by this new pipe mill. Plans call for starting operations at the steel mill in autumn 2012, with annual production output of approximately 350,000 tons of pipes planned for 2013.

Becoming the Largest Player in the U.S. OCTG Market While Adapting to Change

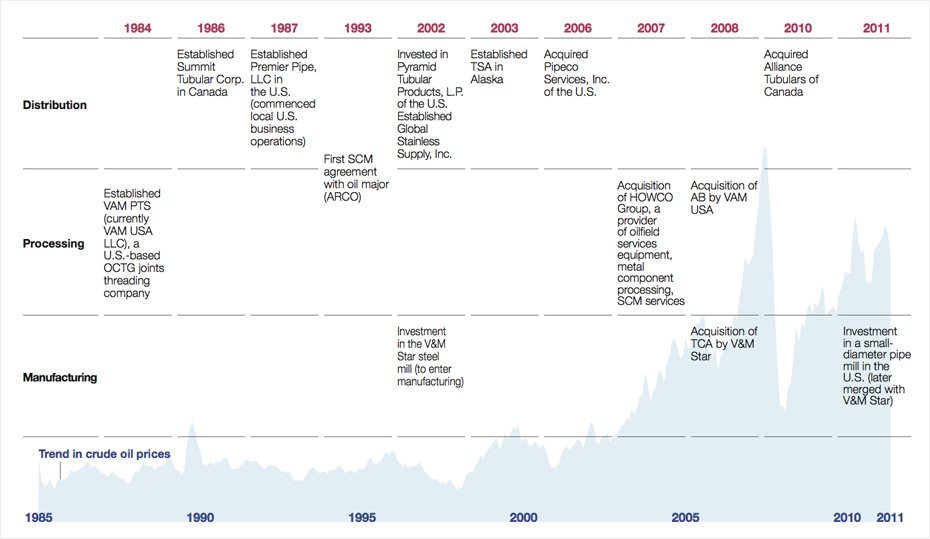

Global OCTG consumption totals about 12 million tons a year. North America con- sumes around 6 million tons, or roughly half, of this global consumption. Sumitomo Corporation boasts a share of about 20% of the North American OCTG market. Initially, Sumitomo Corporation's tubular products business in North America revolved around trading activities, namely the export of pipes manufactured in Japan to the U.S. In the late 1970s, however, trade conflict between Japan and the U.S. started to emerge, and as a result, OCTG exports gradually became subject to trade restrictions. After seeking ways to break through this impasse, Sumitomo Corporation decided to enter the tubular products distribution business in the U.S. and established an OCTG distribution business in 1987. Through this distribution business, Sumitomo Corporation worked tirelessly to enter into stable long-term supply agreements with customers mainly consisting of the oil majors. From 1993, Sumitomo Corporation started to conclude Supply Chain Management (SCM) agreements for tubular products combined with inventory management and various other services. Based on a grasp of changing market conditions, Sumitomo Corporation shifted its business model from exporting tubular products to the U.S. to localized operations in which the company procures OCTG from domestic pipe mills for distribution within the U.S.

In 1995, exports of Japanese OCTG to the U.S. stopped as a result of U.S. anti-dumping measures. At that time, Sumitomo Corporation received requests from oil majors and other customers with whom it had business relationships to continue stably supplying OCTG based on the company's understanding of their needs. To answer their requests, Sumitomo Corporation raced in earnest to secure pipe supply sources within the U.S. These efforts led to the 2002 acquisition of a U.S. seamless pipe mill with Vallourec, marking our first step into manufacturing operations. Thereafter, Sumitomo Corporation remained focused on upgrading and expanding the value chain in step with customer needs and the changing business environment. Measures included investing in a major tubular products distributor and an oilfield service equipment processor and manufacturer.

Strengths of the Tubular Product Business in North America

Sumitomo Corporation's tubular product business in North America is driven by three main strengths: (1) an extensive customer base centered on long-term agreements with a broad range of oil companies, from the majors to small- and medium-sized independent companies; (2) a distribution network capable of just-in-time supply of high-quality products; (3) a support system for smooth operations based on a proprietary IT system, such as a SCM scheme for tubular products.

Normally, oil and gas are found deep underground. The OCTG that draw up these resources require a high level of performance in terms of the ability to withstand high temperatures and pressures, as well as anti-corrosion properties. Previously, our client oil companies had many ancillary duties to perform besides their core business of oil and gas development, including not only procurement of equipment and supplies such as OCTG, but also related processing, inventory management and maintenance. By performing these duties for oil companies on an outsourcing basis, Sumitomo Corporation has striven to provide an environment where its customers can focus on efficient gas and crude oil development.

In addition, oil and gas wells present different conditions, such as size, depth and pressure, depending on the drilling site. There is a need to design optimal wells for each drilling environment at individual oil and gas fields under development and determine the products that will be used. This requires advanced decision making capabilities based on insight and expertise developed over many years. Sumitomo Corporation has its own team of engineers who can address the needs of oil companies conducting drilling operations. This team offers proposals on product applications and other parameters best suited to specific well conditions.

Furthermore, oil well drilling is conducted entirely through on-site operations in oil and gas producing areas. For this reason, various functions must be concentrated on-site. Also, talented human resources who can manage the site are essential. Sumitomo Corporation also has service companies devoted to supply chain management that can be contracted to comprehensively perform these operations. These companies take responsibility for launching facilities and operations, operation and maintenance, systems integration and human resources development.

Generally speaking, OCTG represents 10% of drilling expenses. Sumitomo Corporation has developed an IT system to manage the movement of all OCTG it handles worldwide. It uses this system to manage and predict customers' OCTG usage and to supply products on a just-in-time basis as necessary. Inventory risk is avoided in this way.

Generally speaking, OCTG represents 10% of drilling expenses. Sumitomo Corporation has developed an IT system to manage the movement of all OCTG it handles worldwide. It uses this system to manage and predict customers' OCTG usage and to supply products on a just-in-time basis as necessary. Inventory risk is avoided in this way.

Asserting a Strong Presence in the Global Market While Capturing Customer Needs

While addressing the needs of oil majors and other customers, Sumitomo Corporation conducts OCTG supply chain management at (3) sites in 12 countries worldwide, not just in North America, in its role as a total OCTG solution provider.

Looking ahead, growing global demand for OCTG is anticipated in step with the world's increasing appetite for energy. By continuing to add depth to its value chains and accumulate insights and expertise, Sumitomo Corporation will address the evershifting business environment and customer needs, as it endeavors to provide new value.

Engineers are responsible for oil and gas well consultations. They bridge the gap between Sumitomo Corporation and client oil majors like a translator, so to speak, and propose optimal designs for specific oil and gas well environments.

Engineers are responsible for oil and gas well consultations. They bridge the gap between Sumitomo Corporation and client oil majors like a translator, so to speak, and propose optimal designs for specific oil and gas well environments.