Special Feature 1 Earnings Expansion:Providing new value while staying attuned to customer needs and addressing changes

Tightening Supply-Demand for Electric Power

Indonesia has seen continuous economic growth, along with an ever-increasing population. These developments have led to persistently tight supply-demand dynamics for electric power within the country. Demand for electric power in Indonesia is projected to increase by an average rate of around 8% per year through 2020. Consequently, the development of new sources of electric power has become an urgent priority for the country.

Since entering the Indonesian market in the 1950s, Sumitomo Corporation has been engaged in the construction and operation of a diverse array of power plants in the country, including hydroelectric, thermal, and geothermal power. Through these activities, Sumitomo Corporation has underpinned Indonesia's continuously rising demand for electric power.

Completion of Expansion Work on Tanjung Jati B Coal-Fired Thermal Power Plant

Indonesia is now in the midst of an ongoing construction boom for power plants, mainly on the island of Java, driven by governmentled development of new sources of electric power in order to alleviate power shortages.

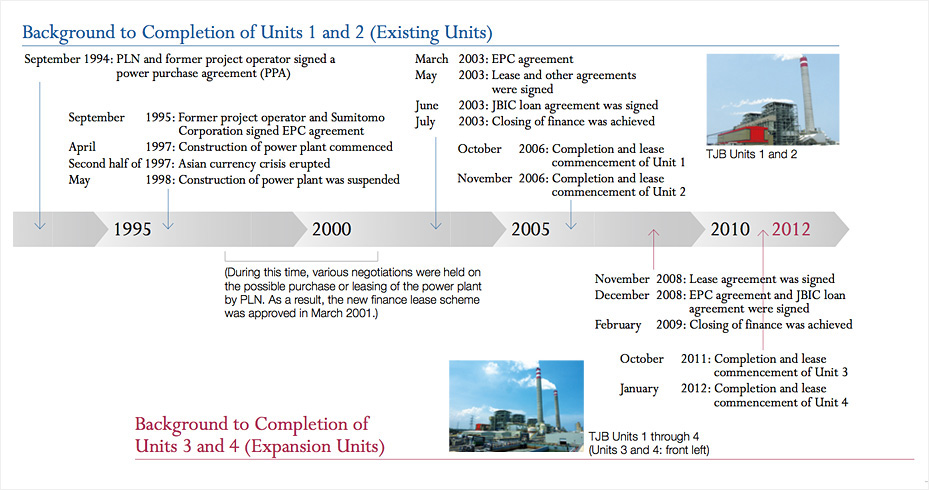

In addition to Units 1 and 2 of the Tanjung Jati B coal-fired thermal power plant (“TJB”) on lease since 2006, Sumitomo Corporation constructed Units 3 and 4. Unit 3 was completed in October 2011, followed in January 2012 by completion of Unit 4. All parties involved from Japan and Indonesia made a concerted effort to complete the expansion work as early as possible, sharing the vision of ensuring a stable supply of electricity in Indonesia. As a result, construction of each unit was completed more than three months ahead of schedule and achieved an output and efficiency surpassing the required levels under the contract terms.

The generation capacity of TJB totals 2,640 MW, following the start of operation of Units 3 and 4. TJB has become a crucial power station, accounting for about 13% of the power supply for the entire Java-Bali power grid in Indonesia.

Source: Ministry of Energy and Natural Resources

Source: Ministry of Energy and Natural Resources

Solving Issues Arising From Environmental Changes One by One

The main factors behind the success of the TJB expansion project were the adoption of the new “finance lease” business model, which was established during the Units 1 and 2 project, a high-quality product and project coordination and implementation skills backed by experience.

The progress of the TJB Units 1 and 2 project was not entirely smooth. In 1995, the TJB project was planned by a Hong Kong-based IPP*. Sumitomo Corporation joined the project as an EPC* contractor responsible for engineering, procurement and construction. However, in 1997, just as construction was proceeding smoothly, the Asian currency crisis erupted and caused the value of the Indonesian rupiah to plummet. The private-sector bank syndicate financing the project withdrew loans from the project at once, and the Hong Kong-based IPP also decided to withdraw. There was no choice but to suspend the TJB project.

At this point, about 70% of the civil work was already completed, and the equipment and facilities were already ordered. More importantly, we did not want to disappoint the people of Indonesia, who had been longing for the completion of the new power plant. Our enthusiasm drove us to repeatedly call on the government to resume the project. To restart the project, Sumitomo Corporation proposed a scheme based on a finance lease. Under this scheme, Sumitomo Corporation constructed the power plant at its own risk with a loan from lenders headed by the Japan Bank for International Cooperation (JBIC). After construction, we have continued our involvement in TJB through the local project company PT. Central Java Power (CJP) by leasing out the power plant to PT. Perusahaan Listrik Negara (“PLN”).

Under this scheme, the lease fee is collected every six months, and the fee level is determined partially based on some variable parameters such as the electricity tariff and certain other factors during each period. Consequently, PLN can avoid incurring initial investment costs and can pay the lease fee from the revenues for the electricity generated at the plant. Another important feature of the scheme is that, unlike an IPP project where only electricity is supplied, the power plant itself is on lease. Therefore, the operation and maintenance of the power station and the procurement of the fuel are done by PLN in cooperation with CJP, which would transfer know-how to a local power generation operator. In addition, the ownership of the power plant facilities could be trans- ferred to the lessee after completion of the 20-year lease period. This feature also made the proposed scheme very attractive to our Indonesian partners.

Having agreed on this “win-win” proposal for both Sumitomo Corporation and its Indonesian partners, the resumption of the project was agreed among the parties in 2001, four years after the project was suspended. We then went through a set of complex negotiations and procedures by exercising our integrated corporate strength and mobilizing a wide variety of our skills, including legal, accounting, tax, and finance and risk management functions. As a result, construction restarted in 2003 and the project was successfully completed in 2006. Despite facing drastic changes in the business environment, Sumitomo Corporation constantly strove to find the best possible solution for its Indonesian partners and itself, thereby guiding this extensive 11-year project to a successful outcome.

Looking ahead, Indonesia is expected to see continued economic development and population growth. We intend to further refine the technical, coordination and project implementation skills we have developed through past activities, as well as our relationships of trust with local partners. Through this approach, Sumitomo Corporation aims to continue growing together with Indonesia.

* IPP: Independent Power Producer

* EPC: Engineering, Procurement and Construction