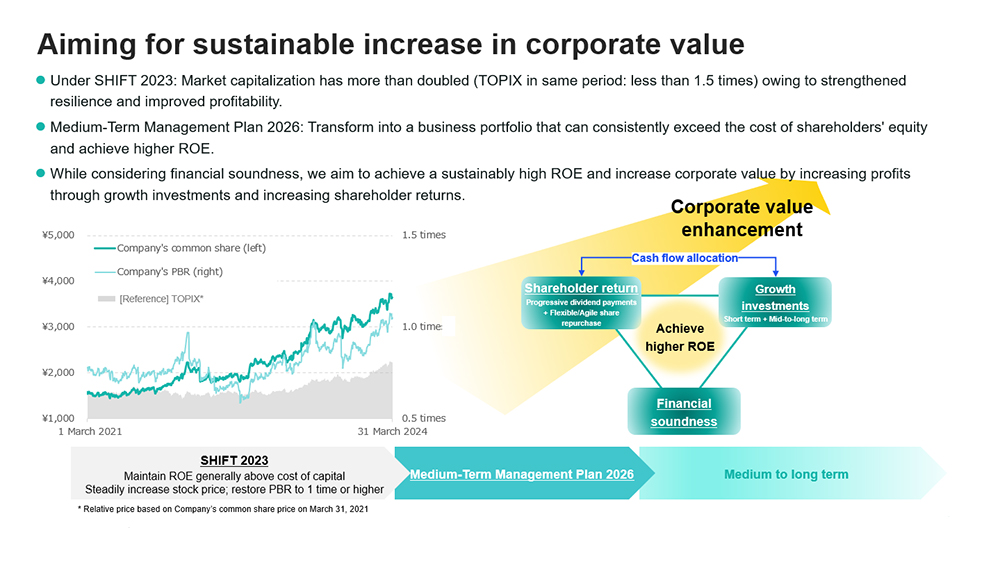

Medium-Term Management Plan 2026

Medium-Term Management Plan 2026

- The contents of this page is as of the announcement of Medium-Term Management Plan 2026 (May 2, 2024).

- Cautionary Statement Concerning Forward-Looking Statements

The contents of this page includes forward-looking statements relating to our future plans, forecasts, objectives, expectations and intentions. The forward-looking statements reflect management's assumptions and expectations of future events at the time of the announcement of Medium-Term Management Plan 2026 (May 2, 2024), and accordingly, they are inherently susceptible to uncertainties and changes in circumstances and are not guarantees of future performance. Actual results may differ materially, for a wide range of possible reasons, including general industry and market conditions and general international economic conditions. In light of the many risks and uncertainties, you are advised not to put undue reliance on these statements. The management forecasts included in this report are not projections, and do not represent management’s current estimates of future performance. Rather, they represent forecasts that management strives to achieve through the successful implementation of the Company’s business strategies. The Company may be unsuccessful in implementing its business strategies, and management may fail to achieve its forecasts. The Company is under no obligation -- and expressly disclaims any such obligation -- to update or alter its forward-looking statements.

About Us