- Overview of Operations

-

- At a Glance

- Metal Products Business Unit

- Transportation & Construction Systems Business Unit

- Environment & Infrastructure Business Unit

- Media, Network, Lifestyle Related Goods & Services Business Unit

- Mineral Resources, Energy, Chemical & Electronics Business Unit

- Messages from Regional Organizations

Main Business

- Steel Sheet-related Field

- Tubular Products Field

- Non-Ferrous Products & Metals Field

Organization

- Planning & Administration Dept., Metal Products Business Unit

- Steel Sheet & Construction Steel Products Division

- Metal Products for Automotive & Railway Industry Division

- Light Metals & Specialty Steel Sheet Division

- Tubular Products Division

Metal Products Business Unit

Message from the General Manager

→ We plan to deepen and enhance our value chain in business fields with prospects for growth

A[Summary of Fiscal 2013] Profit for the year totaled ¥26.6 billion, up ¥9.3 billion year on year. This reflected firm earnings in the North American tubular products business and a solid performance by the steel service center operations due to growth in auto production in Thailand, a recovery in demand for Japanese products in China, and an upturn in the Japanese economy supported by the government's Abenomics policies.

We also made steady progress with efforts to expand our earnings base, including the acquisition of the Edgen Group, a global distributor of metal and tubular products for the energy industry.

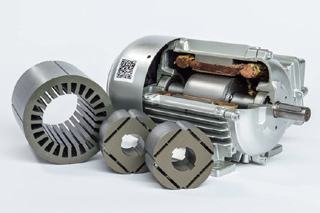

Motor core components made by K+S

[Initiatives for FY2014] In the tubular products business, we plan to invest in the oilfield equipment, material and services field to reinforce our value chain. In the metal products for automotive & railway industry business, we will work to grow exports of long rails, which are becoming more common worldwide. In the aluminum business, we plan to expand our smelting operations in Malaysia.

We also aim to boost profits by implementing our growth strategies for recent acquisitions, the Edgen Group and Kienle + Spiess Gmbh (K+S), a motor core components manufacturing and sales company.

→ We will make new investments and implement our growth strategy for recent acquisitions

The Sakhalin operation team was awarded for achieving seven consecutive years without a lost time accident.

Performance Highlights

| (Billions of yen) | FY2012 | FY2013 | FY2014 forecast |

|---|---|---|---|

| Gross profit | 80.3 | 97.2 | 103.0 |

| Operating profit | 21.8 | 34.6 | - |

| Share of profit of investments accounted for using the equity method | 5.7 | 5.6 | - |

| Profit for the year (attributable to owners of the parent) | 17.3 | 26.6 | 31.0 |

| Total assets | 847.2 | 884.4 | - |

Business Field Overview

Steel Sheet-related Field

What We Aim to Be ![]()

We aim to fulfill growing demand in emerging countries and customer needs globally through business development extending from manufacturing to processing and distribution.

[Business Environment]

In emerging countries, robust consumer spending is fueling growing demand for automobiles, motorcycles, home appliances, and building materials. Further, a shift to railway transportation in developed countries and railway infrastructure development in emerging countries is expected to further boost demand for the steel sheets products

[Strengths and Strategies]

We plan to increase profits by switching to high value-added products and boosting management efficiency, underpinned by sales from the steel service center network spanning 34 companies in 14 countries worldwide, mainly in emerging markets.

In the transportation equipment business, including railway wheels and axles, and crankshafts for automobiles, we will strive to grow market share by developing manufacturing and sales sites in various regions around the world.

[Actions for What We Aim to Be]

Specialized vessel for transporting long rails (150 meters in length)

Our motor core business is well placed to benefit from rising demand for electric vehicles, hybrid cars, and wind power generators on the back of environmental measures and awareness of rising energy costs. In 2013, we acquired K+S, one of Europe's largest motor core manufacturing and sales companies. We are striving to expand the business with the aim of becoming the world's leading maker of motor cores.

In the metal products for automotive & railway industry business, we will use a newly built transport vessel to increase exports of long rails (150 meters in length) in response to rising global demand.

Tubular Products Field

What We Aim to Be ![]()

We aim to enhance and deepen the tubular products value chain in response to increasing energy demand over the medium to long term.

[Business Environment]

Demand for tubular products, including OCTG and line pipes for transporting oil and gas, is anticipated to increase over the medium to long term, in response to growing demand for energy, mainly in emerging countries.

[Strengths and Strategies]

Our business in the tubular products field boasts an industry-leading network and trading volume. This has been achieved by developing operations that demonstrate various value-added functions globally. For example, we have built supply chain management systems around the world, in 14 countries, providing integrated services ranging from ordering of tubular products to inventory management, processing, inspection, transportation and maintenance. We intend to continue enhancing the tubular product value chain we have developed so far, with a view to expanding our earnings base.

[Actions for What We Aim to Be]

A seamless pipe manufacturing site

In November 2013, we acquired all the shares in the Edgen Group, a global distributor of metal and tubular products and materials to the energy industry. In the oilfield equipment, material and services business, an area closely related to the OCTG field, the Howco Group, which we acquired in 2007, is expanding its operations. We plan to reinforce our presence in the field to further expand our tubular products value chain.

Non-Ferrous Products & Metals Field

What We Aim to Be ![]()

We will bolster our relationships with global players to build cost-competitive value chains.

[Business Environment]

The scope of usage and application of aluminum, titanium and other non-ferrous metal products is broadening. This market should continue to expand, given the strong need to reduce the weight and improve the fuel economy of automobiles, aircraft and other transportation equipment.

[Strengths and Strategies]

In the aluminum business, we boast one of the highest transaction volumes in aluminum sales in Japan. We aim to build a value chain in the growing global market for aluminum by accelerating the development of production locations from smelting operations upstream to rolling mills midstream.

[Actions for What We Aim to Be]

Aluminum ingots manufactured at Press Metal Berhad

In Malaysia, we are developing aluminum smelting operations with Press Metal Berhad, the country's largest aluminum extrusion products company. In November 2013, we signed an agreement to participate in the second phase of the project, which will roughly triple the size of our aluminum smelting business in Malaysia. These moves are part of wider efforts to expand our value chain in the aluminum business.

Project Overview

Large-diameter tubular product for use as line pipe

In November 2013, we acquired all the shares in the Edgen Group, a global distributor of metal and tubular products for the energy industry. The cost of the share purchase was roughly ¥52 billion.

Edgen has a global network of 35 business sites in 18 countries, supplying products such as oil and gas line pipe, specialty tubular products for power plants and petrochemical plants, and steel materials used in offshore structures. In the U.S., Edgen is also a distributor of OCTG for shale development projects.

Based on global exports of tubular products, we have built a supply chain management system capable of supplying products to client sites on time, upgraded our wholesale distribution network, mainly in the U.S., boosted supply capacity by investing in tubular product mills and processing facilities, and acquired wholesale processors of oil field equipment as part of a concerted effort to expand our oil field-related value chain.

This latest acquisition will allow us to reinforce our existing manufacturing and distribution networks for OCTG and line pipe in line with strong demand from shale development. Another aim of the acquisition is to strengthen our sales network to address demand for tubular products, fittings and flanges in the construction of new oil refinery, petrochemical and power plants, and for steel sheets, steel plates and tubular products used in offshore oil and gas field development, which is projected to see strong growth.

We will work to satisfy the increasingly sophisticated demands of clients by deepening our value chain to enhance our service provision capabilities worldwide.