- Overview of Operations

-

- At a Glance

- Metal Products Business Unit

- Transportation & Construction Systems Business Unit

- Environment & Infrastructure Business Unit

- Media, Network, Lifestyle Related Goods & Services Business Unit

- Mineral Resources, Energy, Chemical & Electronics Business Unit

- Messages from Regional Organizations

Main Business

- Ship, Aerospace & Transportation Systems Field

- Automotive Field

- Construction Equipment Field

Organization

- Planning & Administration Dept., Transportation & Construction Systems Business Unit

- Ship, Aerospace & Transportation Systems Division

- Automotive Division, No. 1

- Automotive Division, No. 2

- Construction & Mining Systems Division

Transportation & Construction Systems Business Unit

Message from the General Manager

→ We will enhance and reinforce our capabilities to tap growth in global transportation demand.

A[Summary of Fiscal 2013] Profit for the year increased ¥3.2 billion year on year to ¥48.8 billion in fiscal 2013, supported by earnings from the aircraft leasing business and firm demand in the automobile financing business in Indonesia, the automotive leasing business in Japan and the construction equipment rental business in the U.S.

We also jointly established an aircraft engine leasing company in the Netherlands with MTU Aero Engines AG to address the wide-ranging needs of the airline sector.

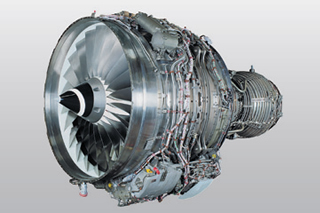

The V2500 engine is a key product of aircraft engine leasing operations

[Initiatives for FY2014] In the ship, aerospace and transportation systems field, we plan to gradually ramp up aircraft engine leasing operations, using the aircraft leasing business as a platform to build up our value chain, including areas such as parts and maintenance services. In the automotive field, we will draw on our strengths in the domestic market to expand our automotive leasing business overseas and also diversify our automotive financing operations in emerging countries. In addition, we plan to increase production capacity at our automotive components and automobile manufacturing operations in Mexico and other markets. In the construction equipment field, we will drive business expansion by increasing the operational reach and expanding the asset portfolio of Sunstate Equipment Co., LLC, a leading U.S. construction equipment rental company.

→ We will diversify our operations and step up global expansion, centered on existing businesses.

Completed image of Vietnam's first urban railway system

Performance Highlights

| (Billions of yen) | FY2012 | FY2013 | FY2014 forecast |

|---|---|---|---|

| Gross profit | 123.2 | 124.7 | 133.0 |

| Operating profit | 25.8 | 34.5 | - |

| Share of profit of investments accounted for using the equity method | 27.3 | 27.7 | - |

| Profit for the year (attributable to owners of the parent) | 45.6 | 48.8 | 46.0 |

| Total assets | 1,302.0 | 1,443.5 | - |

Business Field Overview

Ship, Aerospace & Transportation Systems Field

What We Aim to Be ![]()

We will establish a stable earnings base and target balanced growth in shipping, aircraft, railway and related leasing businesses.

[Business Environment]

Although the shipping market is lackluster, demand for new ship construction has been kept since last year because of the affordable price level. We also expect increasing longer-term demand for commercial aircraft based on the growth in emerging countries, as well as growing global demand for railways driven by a modal shift in transportation.

[Strengths and Strategies]

In the ship business, we will enhance and expand our revenue base by capitalizing on our broad customer base built up through our trading activities and our value chain encompassing operations of ships owned and jointly owned as well as shipyard business through Oshima Shipbuilding Co., Ltd. With SMBC Aviation Capital, we will strive to further expand the aircraft leasing business by capturing demand for commercial aircraft in emerging countries, especially in Asia. We will also bolster businesses surrounding the growing commercial aviation market. In the railway business, we aim to win large orders continuously in North America, Southeast Asia and also other regions based on expertise amassed in the construction of urban railway systems.

[Actions for What We Aim to Be]

Expanding Aircraft leasing business

We have teamed up with Germany's MTU Aero Engines AG to launch an aircraft engine leasing business. We plan to offer packaged services that include parts and maintenance support.

Automotive Field

What We Aim to Be ![]()

We plan to reinforce the earnings base by enhancing key functional capabilities of our automotive value chain and by expanding globally.

[Business Environment]

Looking ahead, we anticipate sustained growth in demand in emerging countries as motorization takes hold. In developed countries with mature markets, we foresee new growth opportunities arising due to business model innovation and strategic alliances.

[Strengths and Strategies]

In lease and financing, we will develop overseas operations in collaboration with Sumitomo Mitsui Auto Service Company, Limited, which is now Japan's largest automobile leasing group. In automobile and motorcycle financing operations in Indonesia, we aim to leverage our strong customer base and business infrastructure to move into peripheral business areas.

In manufacturing, we are expanding our automobile parts manufacturing business in emerging markets—especially Asia and Mexico—centered on KIRIU Corporation. We will also focus on automobile production.

In automotive sales, we plan to boost sales in emerging countries such as Libya, Iraq and Myanmar.

[Actions for What We Aim to Be]

Automobile manufacturing joint venture with Mazda Motor

In Mexico, we have started mass production at our automobile manufacturing joint venture with Mazda Motor Corporation. We plan to reinforce our manufacturing operations in Mexico by expanding our local KIRIU plant and through an investment in an auto parts business operated by Hiroshima Aluminum Industry Co., Ltd.

Construction Equipment Field

What We Aim to Be ![]()

We aim to expand our sales and service operations in emerging and resource-rich countries and reinforce our rental business in developed countries.

[Business Environment]

Demand for construction equipment is expected to grow in emerging countries in line with an increase of infrastructure to be developed. Demand is also expected to expand in the U.S., the largest rental market for construction equipment in large part due to a recovery in construction investment.

[Strengths and Strategies]

Our construction equipment business in Canada has become our largest source of earnings on the back of sales of construction and mining equipment, coupled with success in capturing demand for parts and services.

In the U.S. and Japan, the market is increasingly shifting from owning to renting, which is supporting earnings growth in our rental business. In China, we are strengthening the basis of our dealership operations in preparation for a full-scale recovery in the market. Also, we are working to expand the earnings base in emerging countries by developing our business in the Middle East and Asia. In Mongolia and Russia, we are expanding our comprehensive mining equipment related business, working closely with customers.

[Actions for What We Aim to Be]

The stockyard and workshop of A.L.J. Summit

In Saudi Arabia, we teamed up with a local partner to establish Abdul Latif Jameel Summit Co., Ltd. (A.L.J. Summit), which imports and sells construction equipment and provides related services. We plan to expand our dealership operations, which is the origin of our construction equipment business, into other countries in the Middle East and other regions such as Africa and Asia.

Project Overview

Our construction equipment business in the U.S. started in the 1980s with the establishment of a wholesale company in partnership with a Japanese construction equipment manufacturer. We also invested in a Japanese construction equipment manufacturing and sales company. In the 1990s, we developed and expanded the business through the acquisition of local dealership operations.

Also, by leveraging our expertise in the domestic construction equipment rental business, we invested in a leading U.S. construction equipment rental company Sunstate Equipment in 2008 which gave us much greater access to the world's largest construction equipment rental market.

Although Sunstate Equipment faced severe challenges during the financial crisis after the collapse of Lehman Brothers, as the market recovered from 2011, the company expanded its rental fleet in response to customer demand, driving a V-shaped recovery in growth. The U.S. is the world's largest equipment rental market in size, however, the rental equipment usage ratio is still lower than in Japan and the U.K., pointing to significant room for further market growth. Given this outlook, we took a controlling stake in Sunstate Equipment at the end of 2012, aiming to expand earnings further.

Going forward, we plan to increase market share in existing fields and go into the fast-growing oil and gas-related equipment rental market. This will be a part of active efforts to expand our scope of customers and operational reach to reinforce the earnings base. We will also look at acquiring local competitors to achieve our growth strategy more rapidly.

The company's yard stocked with rows of diverse equipment

Overview of Sunstate Equipment Co., LLC

| Establishment: | 1977 |

| Location: | Phoenix, Arizona |

| Bases: | 56 bases in 9 Southwestern U.S. States |

| Sales: | Approx. $300 million |

| Business: | Rental of aerial work platforms and construction equipment, etc. |