- Overview of Operations

-

- At a Glance

- Metal Products Business Unit

- Transportation & Construction Systems Business Unit

- Environment & Infrastructure Business Unit

- Media, Network, Lifestyle Related Goods & Services Business Unit

- Mineral Resources, Energy, Chemical & Electronics Business Unit

- Messages from Regional Organizations

Main Business

- Mineral Resources & Energy Field

- Chemical & Electronics Field

Organization

- Planning & Administration Dept., Mineral Resources, Energy, Chemical & Electronics Business Unit

- Mineral Resources Division No. 1

- Mineral Resources Division No. 2

- Energy Division

- Basic Chemicals & Electronics Division

- Life Science Division

Mineral Resources, Energy, Chemical & Electronics Business Unit

Message from the General Manager

AAmid rising demand for mineral resources and energy on the back of global population growth and economic expansion, mainly in emerging countries, we expect the development of technologically challenging deep-sea oil fields and U.S.-led development of shale oil and gas resources to gain momentum. Meanwhile, changing lifestyles in emerging countries are likely to drive qualitative and quantitative growth in demand for food resources. In order to meet this demand, agricultural production will need to become more efficient, especially due to concerns about the impact of climate change caused by global warming on agricultural yields.

→ We will tap growing demand for resources and energy over the medium and long term through business investment and trading activities.

A[Summary of Fiscal 2013] Although profits rose at our South African iron ore operations on the back of sales volume increase, etc., profit for the year declined ¥23.7 billion to ¥24.0 billion. This mainly reflected impairment losses on the Isaac Plains coal mining project in Australia due to falling prices.

We took steps to enhance the value of major investments, such as starting up commercial production at the Ambatovy nickel project in Madagascar. We also made progress on a U.S. LNG project, which is scheduled to start exports to Japan in 2017.

Ambatovy nickel plant in Madagascar

[Initiatives for FY2014] In the upstream resource and energy field, we will put priority on steadily ramping up production at projects currently under development. We also plan to continue improving the cost competitiveness of existing projects while steadily implementing expansion plans. At the same time, we aim to raise the quality of our portfolio by replacing assets. In midstream and downstream fields, we intend to push ahead with the U.S. LNG export project as planned, while also developing our overseas ferroalloy and petrochemical manufacturing operations. Also, we will work to build our agricultural value chain by further expanding the sales network in our global crop protection business and by enhancing and developing our multifaceted crop-production support business* worldwide.

- * A one-stop operation providing materials and services needed in agricultural production

→ We will ensure that projects currently under development start up steadily and step up efforts to boost value.

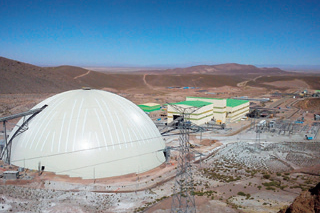

The San Cristobal Technical Institute in Bolivia

AWe are engaged in the development of mines worldwide. Our mining projects can only remain viable by contributing to the sustainable development of local communities, especially those near the mines. At our San Cristobal mine in Bolivia, South America, we have set up a technical institute to provide additional training to technicians who work at the mine. We also opened the institute to local people to help them acquire the technical skills they need to become economically independent. We are also contributing to local communities by building public infrastructure such as roads, bridges, water supplies, hospitals and schools, and we have implemented a number of environmental conservation measures at the mine, such as constructing a dust mitigation dome over the ore stockpile and using ground water resources in a sustainable manner.

Performance Highlights

| (Billions of yen) | FY2012 | FY2013 | FY2014 forecast |

|---|---|---|---|

| Gross profit | 89.0 | 80.5 | 97.0 |

| Operating profit | 26.8 | (10.8) | - |

| Share of profit of investments accounted for using the equity method | 30.8 | 36.9 | - |

| Profit for the year (attributable to owners of the parent) | 47.7 | 24.0 | 38.0 |

| Total assets | 1,400.1 | 1,614.5 | - |

Business Field Overview

Mineral Resources & Energy Field

What We Aim to Be ![]()

Through investment in upstream interests and trading activities, we aim to contribute to the stable supply of mineral resources and energy.

[Business Environment]

Resource prices have been weak for some time due to slowing economic growth in China and other emerging countries. However, we forecast increased demand for mineral resources and energy over the medium and long term. Also, the global energy supply and demand landscape is being transformed amid active development of unconventional energy resources.

[Strengths and Strategies]

We will optimize our portfolio of resource interests with an eye to longer-term demand growth. The focus will be key strategic resources. We will also take into account time factors like the start of production and mine life, regional considerations including country risk diversification, and the participation style such as alliances with prime partners and upgrade of the functions we provide. Through our mining businesses including at the San Cristobal silver, zinc and lead mining project in Bolivia, where we have assumed full ownership, we are building up our mining operation expertise and nurturing numerous personnel. In our U.S. non-conventional gas business, we will work to build a gas value chain traversing upstream operations to distribution, liquefaction and LNG export. We will do this by combining knowledge and experience in upstream shale gas development with the functions of our U.S. natural gas trading company.

[Actions for What We Aim to Be]

MUSA iron ore operation in Brazil.

San Cristobal silver, zinc and lead mine in Bolivia

Along with bolstering our existing interests' cost competitiveness and firmly moving expansion plans forward, we are concentrating on steadily executing large-scale upstream resource projects. In the U.S. shale oil and gas development project we joined, we are conducting geological surveys and raising the drilling efficiency as we move forward with development and production. At the Sierra Gorda copper mine project in Chile, we are working toward starting production in 2014. In Brazilian Mineração Usiminas S.A. (MUSA) iron ore mining operations, we are advancing plans for expansion. At the Ambatovy nickel project in Madagascar, where commercial production has begun, we are continuing to increase the plant operating rate, aiming to achieve early full production. At the aforementioned San Cristobal mine, we are working to enhance the project's value through ongoing exploration aimed at increasing the ore reserve. In the meantime, we acquired an interest in the Clermont thermal coal mine for our coal mining operation in Australia. In midstream and downstream business, we acquired an export permit from the U.S. Department of Energy for our Cove Point LNG project in Maryland, where preparations are underway to begin exports in 2017. In Malaysia, we are working toward completing the construction of a manganese alloy smelting facility in 2016.

Chemical & Electronics Field

What We Aim to Be ![]()

We will achieve prosperity and realize dreams by developing sophisticated and distinctive operations and trading activities worldwide.

[Business Environment]

With food demand rising as emerging countries' populations increase and economies develop, crop protection products and fertilizers that improve the quality and yield of agricultural produce should see growing demand. Furthermore, the use of shale gas has brought about structural change in the chemicals industry.

[Strengths and Strategies]

We will work to build our multifaceted cropproduction support business by moving into new areas, handling new products and securing additional licenses in our global crop protection business and by generating synergies with our fertilizer operations.

We also plan to develop our gas chemicals-related operations as a peripheral business to our U.S. shale gas upstream interests.

[Actions for What We Aim to Be]

Alcedo's grain silos in Romania

We have established crop protection chemical sales companies in Turkey and Chile as part of efforts to strengthen our global sales network. We are also further enhancing our multifaceted crop-production support business through our Romanian agricultural materials distribution company Alcedo S.R.L. In China, we took a stake in Spanish company CEPSA Quimica S.A.'s local petrochemical manufacturing operations, while in Russia, we invested in a high-purity quartz production business. In the electronics business, we are reinforcing the EMS business foundation and working to expand the value chain.

Project Overview

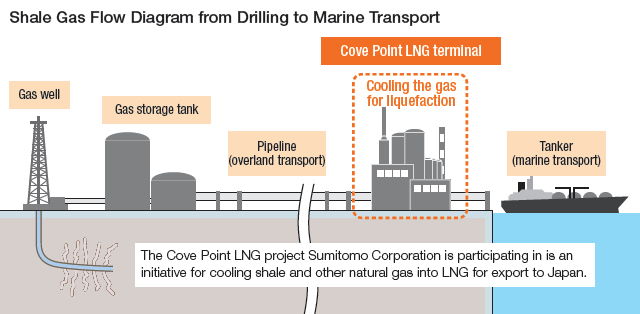

Japan's demand for liquefied natural gas (LNG) has been growing since the shutdown of nuclear reactors after the Great East Japan Earthquake in 2011. LNG exports from the U.S. are seen as one way of meeting this demand.

We are a partner in the Cove Point LNG project in the U.S. state of Maryland, which is led by Dominion Cove Point LNG, LP (Dominion). Under the project, shale and other natural gas in the U.S. will be processed at a new liquefaction plant built by Dominion at Cove Point for export to Japan as LNG. In September 2013, the project received approval from the U.S. Department of Energy to export LNG to countries that do not have a free trade agreement (FTA) with the U.S. The project partners are aiming to start exports in 2017 after construction approval has been granted by the Federal Energy Regulatory Commission (FERC), which is expected sometime during 2014.

Leveraging the expertise and networks we have built up in our U.S. natural gas trading and marketing operations since 2004, we plan to play a key role in exports of LNG to Japan using stable, long-term supplies of U.S. natural gas via the new liquefaction plant. We have signed a contract with Dominion for processing approximately 2.3 million tons of LNG per year, which we plan to sell to Tokyo Gas Co., Ltd. and The Kansai Electric Power Co., Inc. over 20 years from 2017.

Through the Cove point project, we aim to diversify Japan's LNG supply sources and procurement pricing formula by supplying LNG that tracks the price of U.S. natural gas. This will help Japan secure stable supplies of energy from more diverse sources.