Promoting Our Medium-Term Management Plan—BBBO2017Special Feature 1Chief Strategy Officer x Chief Financial Officer

InterviewResponding to Operating

Environment Changes

1.Qualitative Progress

Promote Managerial Reforms

Could you please explain progress with regard to measures to “improve corporate governance and decisionmaking process,” a policy listed under the objective of “promote managerial reforms” in BBBO2017?

Improvement of Decision-Making Processes

Striving to improve decision-making processes, the Management Council was designated as the highest decision-making body at the operational execution level in July 2015. Accordingly, this council will be responsible for making decisions related to management policies and issues impacting the entire Company. This change in authority has enabled for frank discussions among members of the council and made it possible to incorporate a more diverse range of opinions.

In addition, we increased the number of Outside Directors on the Board of Directors by one, making for three (an additional Outside Director was appointed at the Ordinary General Meeting of Shareholders held on June 24, 2016, making for four Outside Directors as of August 2016). We also revised the standards for determining agenda items for Board of Directors meetings with the aim of allowing the Board to focus more on discussions of management policies, plans, and other important matters pertaining to all of management. Other initiatives included expanding the range of items reported to the Board of Directors, reinforcing oversight for the execution of management, and establishing a deliberation system that centers on formulating Companywide strategies and basic policies.

Response to the Corporate Governance Code

As part of our response to Japan's Corporate Governance Code, we revised the Sumitomo Corporation Corporate Governance Principles.

Also, in November 2015, we established the Nomination and Remuneration Advisory Committee to take the place of the prior Remuneration Committee. Created with aim of increasing the transparency and objectivity of processes for nominating and deciding the remuneration of Directors, the new committee functions as an advisory body to the Board of Directors and is membered by a majority of Outside Directors while being chaired by an Outside Director (see “Corporate Governance System”).

Furthermore, in fiscal 2015 based on self-evaluations conducted by Directors and Corporate Auditors, the Company began instituting third-party analyses and evaluations of the effectiveness of the Board of Directors with the aim of ensuring sustainable growth and improving corporate value. Based on the results, we carried out various reforms for creating an effective Board of Directors and steadily generated results on this front. Issues with regard to improving the Board of Directors effectiveness pointed out through these analyses and evaluations included the need to increase the amount of management information provided to Outside Directors and Outside Corporate Auditors and to expand the range of opportunities for exchanging opinions among Directors and Corporate Auditors. Going forward, we will perform in-depth analyses of this situation and, based on discussions by the Board of Directors, implement measures to improve the effectiveness of the Board.

From the perspective of large-scale investment projects, what progress was made with regard to the policy of “strengthen risk management system”?

In making investment decisions related to particularly large and important projects, candidate projects are discussed several times by Unit Investment Committees and the Company Investment Committee. By deliberating on projects at the Unit and Companywide levels during the initial investment consideration stage and execution stage, we conduct discussions at an even-deeper level than before. This approach serves to heighten the quality of decisions by evaluating such factors as the characteristics of projects, the appropriateness of the investment theme, and the connection between the investment and the business's strategies.

Decision-making authority for other projects is delegated to the front lines to increase the speed of investment decisions.

Rather than implementing a uniform Companywide hurdle rate, we review investment evaluation standards and make investment decisions in consideration of an anticipated rate of return that is determined based on the specific risks inherent in a given project. For large-scale projects, we have reconstructed our post-investment monitoring frameworks through measures such as systematizing “100-day plans.”

Through this plan system, shortly after investment, personnel from both business divisions and corporate divisions begin building up relationships with the management of the investee. At this time, we collaborate with the investee to formulate a medium-term plan detailing the management and financial indicators that need to be targeted.

Promote Growth Strategies

Another major objective of BBBO2017 is to “promote growth strategies.” How was progress with regard to the policy of “encourage and step up cross-organizational collaboration”?

A Companywide growth strategy set forth in BBBO2017 is to encourage an even-greater degree of cross-organizational collaboration in industries where we expect strong growth over the medium-to-long term. Through such collaboration, we will advance initiatives that leverage our integrated corporate strength to create new value in automobile-related businesses, IoT businesses, retail businesses in Asia, energy-related businesses, food and agriculture-related business, and other fields.

In retail businesses in Asia, for example, Group companies P.T. Oto Multiartha and P.T. Summit Oto Finance.jointly referred to as the OTO Group.are developing an automotive financing business in Indonesia, which has cultivated a massive customer base of 1.7 million users. Seeking to take advantage of this customer base in retail finance fields outside of automobiles, we commenced investment in commercial bank PT. Bank Tabungan Pensiunan Nasional Tbk (BTPN) in February 2015. By fully leveraging the customer bases and business networks of both the OTO Group and BTPN, we aim to cater to the robust consumption demand from Indonesia's growing middle class by developing finance businesses targeting various retail sectors. At the same time, we will promote collaboration between these companies and other Group companies to advance multifaceted business ventures that include such areas as logistics. Looking at the whole Company from the viewpoint of industries and functions, we will step up crossorganizational collaboration between highly compatible businesses to bolster earnings capacity.

What progress has been made in the effort to “improve policies for upstream mineral resources and energy businesses,” in which large impairment losses were recognized in both fiscal 2014 and fiscal 2015?

We have been focusing on starting up projects with recent investments, such as the Nickel Project in Madagascar, for which financial completion was achieved in September 2015 (see “Special Feature 2: Initiatives under BBBO2017”).

We also pushed forward with ongoing cost reduction measures in existing projects. At the same, we are aspiring to create a business portfolio that features not only dispersed risks but also resilience to market downturns. To this end, we formulated management policies for our portfolio of upstream mineral resources projects that include standards for the ratio of unfinished projects to total projects and the maximum risk exposure to be allowed per project. In addition, we established the Project Management Department for Mining & E&P as a dedicated organization tasked with enhancing our market analysis and technical evaluation capabilities, assembling a staff with expertise in these areas. With regard to new upstream mineral resources investments, our basic policy will be to focus on the replacement of existing assets while enhancing our project discernment and risk management skills. We will thus take a cautious approach toward future investments, turning our attention mainly to projects that are already operating competitively.

Regarding the policy of “promote growth strategies in each division,” what investments were conducted during fiscal 2015?

In fiscal 2015, we conducted investments totaling ¥150.0 billion in three fields of strength, namely Automobile and Transportation Systems, Infrastructure, and Lifestyle and information services.

The main investments were for increasing assets in the construction equipment rental business in the United States and for real estate, such as commercial facilities. When investments related to existing upstream mineral resources projects and other projects are included, total investments registered approximately ¥270.0 billion.

2.Revision of Quantitative Performance Targets

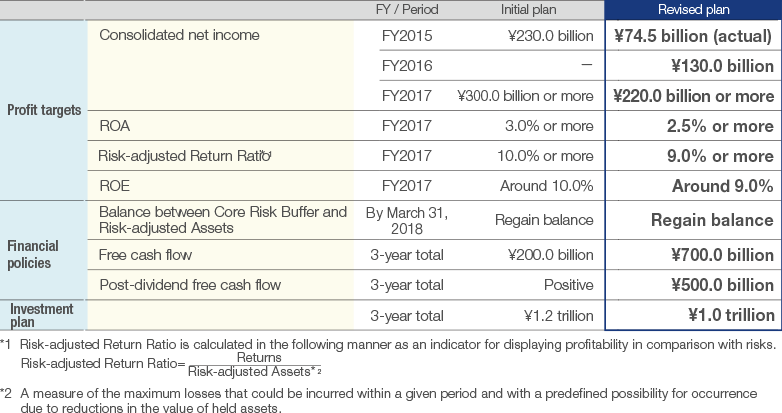

The Company revised the quantitative profit targets and cash flow targets decided for BBBO2017 in March 2015. What were the main points for these revisions?

Revision of Profit Targets

With regard to our fiscal 2016 forecasts, solid conditions are anticipated in non-mineral resources businesses, such as the core businesses of the Environment & Infrastructure Business Unit and the Media, Network, Lifestyle Related Goods & Services Business Unit.

Mineral resources businesses and the tubular products business, meanwhile, will continue to face a harsh operating environment due to low resource and energy prices. Given the ongoing uncertain business outlook, we plan to accelerate asset replacement focused on low-margin and low-efficiency businesses. Our fiscal 2016 forecasts account for approximately ¥20.0 billion earmarked for asset replacement costs (“Costs for structural improvement”), therefore we are projecting consolidated net income for the year of ¥130.0 billion.

For fiscal 2017, despite initially projecting consolidated net income for the year of ¥300.0 billion or more, our target has since been lowered to ¥220.0 billion or more. Reasons for this downward revision include a projected delay in recovery in mineral resources businesses and the tubular products business, which will be a result of the persistence of low resource and energy prices. This target represents a ¥90.0 billion increase from the forecasts of ¥130.0 billion for fiscal 2016 and also accounts for approximately ¥20.0 billion of “Costs for structural improvement.” Of the projected increase of ¥90.0 billion, around ¥50.0 billion is expected to come from non-mineral resources businesses other than the tubular products business. In these businesses, we anticipate earnings contributions from projects with recent investments and new businesses as well as growth in existing businesses.

Specific examples of contributing businesses include automobile manufacturing, overseas power infrastructure, domestic media, real estate, and a telecommunication project in Myanmar.

Meanwhile, ¥30.0 billion of this increase will come from mineral resources businesses, which will benefit from a certain degree of recovery in market conditions.

The remaining ¥10.0 billion of this increase is expected from the tubular products business. In addition to some extent of market recovery, this business will benefit from our efforts to reinforce its constitution through measures such as business reorganization aimed at ensuring this business can quickly be set back on the path toward earnings growth when the market takes an upswing.

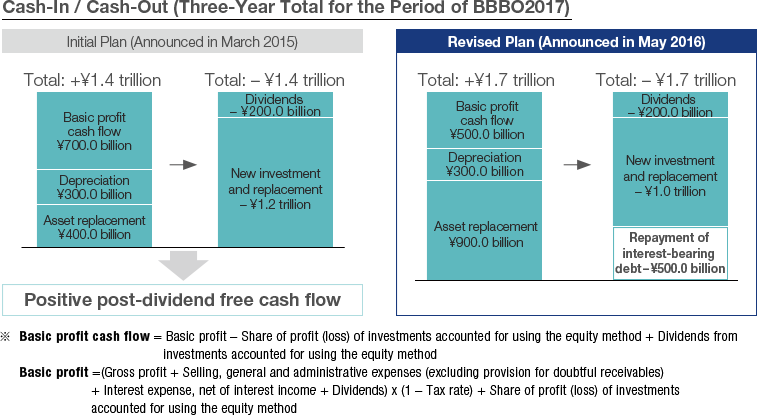

Revision of Cash Flow Targets

Next, I will explain the main points regarding the revisions to our cash flow targets. For cash-in, we are now targeting basic profit cash flow of ¥500.0 billion, ¥200.0 billion less than our initial target of ¥700.0 billion.

Conversely, we have set a higher target of ¥900.0 billion for funds recovered through asset replacement, which stands at ¥500.0 billion above our previous target of ¥400.0 billion. Recovery of these funds will primarily be conducted through asset replacement in relation to low-margin and low-efficiency transactions. When factoring in the effects of ¥300.0 billion in depreciation and amortization, this will generate total cash of ¥1.7 trillion.

As for cash-out, ¥200.0 billion will be returned to shareholders in the form of dividends. Meanwhile, the planned amount of investments has been reduced by ¥200.0 billion from the initial figure of ¥1.2 trillion.

This amount of ¥1.0 trillion will primarily be allocated to investments in growth areas. While setting aside funds for shareholder returns and future investments, we aim to secure post-dividend free cash flow of ¥500.0 billion, which will be used to repay interest-bearing debt to strengthen our financial position.

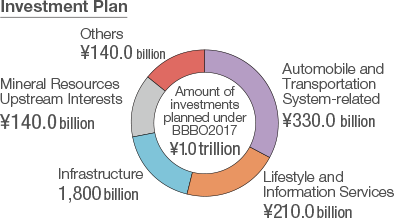

The ¥1.0 trillion of investment will be conducted in fields where we can leverage our strengths and in which we can expect strong growth.

By field, we will invest ¥330.0 billion in Automobile and Transportation System field, primarily in relation to materials and parts for automobiles; ¥210.0 billion in Lifestyle and Information Service field, largely for IT-related, mobile, and real estate investments; and ¥180.0 billion in Infrastructure field, which will mainly be aimed at domestic and overseas power infrastructure projects. In this manner, our plan to focus investment on these three fields will remain unchanged. Meanwhile, in Mineral Resources Upstream Interests, while we had initially planned ¥100.0 billion in investments to be made in relation to fund contributions necessitated by contracts concluded for existing projects, this amount has been raised to ¥140.0 billion due to a sluggish market.

Have there been any changes with regard to your policy for the balance between Core Risk Buffer and Risk-adjusted Assets?*3

At the start of BBBO2017, Risk-adjusted Assets exceeded Core Risk Buffer by slightly more than ¥140.0 billion. There will be no changes to our policy of regaining the balance between Core Risk Buffer and Risk-adjusted Assets, which represents a fundamental principle of management, and we will continue to place initiatives with respect to this as a top priority. As of March 31, 2016, Risk-adjusted Assets exceeded Core Risk Buffer by slightly more than ¥60.0 billion.

- *3Core Risk Buffer represents the sum of common stock, retained earnings, and foreign currency translation adjustments minus treasury stock, at cost. Our basic management policy is to keep Risk-adjusted Assets, which represent the maximum possible losses, within the scope of Core Risk Buffer.

In closing, do you have any messages for Sumitomo Corporation's stakeholders?

To expand earnings backed by our solid financial base, we will steadily repay interest-bearing debt. In addition, as we revise our risk management systems, we will increase our investment success rate and thereby return the Company to the growth track.

The operating environment for Sumitomo Corporation is changing rapidly, and it is therefore important for us to remain committed to doing what must be done. For this reason, I hope that management and employees will be able to band together to accelerate our managerial reforms so that we may advance our growth strategies in stride and move forward with BBBO2017.