Promoting Our Medium-Term Management Plan—BBBO2017Special Feature 2Initiatives under BBBO2017

Stepping up Cross-Organizational Collaboration that Exploits Foundations in Media, Retail, and Real Estate

The Sumitomo Corporation Group operates an array of different businesses in 66 countries. Under the medium-term management plan “Be the Best, Be the One 2017” (BBBO2017), we will step up cross-organizational collaboration and exploit our integrated corporate strength to advance business activities in industries, functions, and regions that promise robust medium-to-long-term growth.

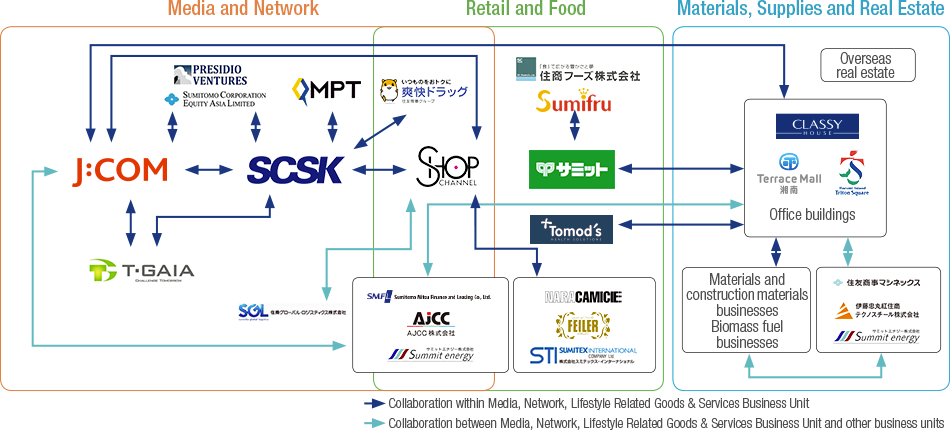

Increasing Collaboration through J:COM

Taking advantage of the complete deregulation of the electricity retail market, Jupiter Telecommunications Co., Ltd. (J:COM), a Cable TV and system operator in which we have a 50% stake, began selling electricity to such low-volume consumers as the residents of detached houses or small apartment buildings in April 2016. A wholly owned subsidiary that supplies and procures electricity, Summit Energy Corporation, and J:COM.which offers services rooted in local communities and households through Cable TV.will work together and exploit each other's strengths to supply customers with electricity, which is an essential of day-to-day life.

Moreover, J:COM collaborates with the Group's condominium operations. Through participation in the product planning and design stages of condominiums that the Group develops, J:COM will acquire new customers, retain existing customers, and heighten customer satisfaction by offering Cable TV, Internet, and batchelectricity provision services.

Other cross-organizational collaborations involving J:COM include using the capital reorganization of TV shopping business Jupiter Shop Channel Co., Ltd., implemented in March 2016, as an opportunity to create synergies (see “Project Overview”). Also, IT service provider SCSK Corporation is working with J:COM to develop and operate its customer database system.

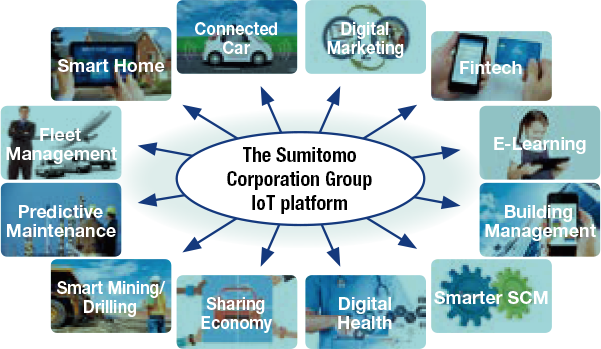

Advancing IoT Initiatives

We view the Internet of Things (IoT), which would bring disruptive innovation to society and industry, as a huge business opportunity.

Aiming to advance IoT initiatives on a cross-organizational basis, the Network Division led efforts to establish a Groupwide working group in April 2016. The group is tasked with enhancing corporate value throughout the Sumitomo Corporation Group by leveraging IoT to upgrade businesses and create new business models.

Utilizing Group Networks to Create Profit Opportunities

There are many other types of cross-organizational collaboration within the Sumitomo Corporation Group. For example, we realize collaboration centered on the real estate businesses by setting up Summit supermarkets and Tomod's drugstores in the retail facilities and condominiums that we develop. Moreover, during the construction of these retail facilities and condominiums, we lease construction equipment and supply such construction materials as steel frames and cement. Also, we provide supplies of biomass fuel to our biomass power business. By strengthening and promoting Groupwide collaboration that transcends the boundaries of business segments or regions, we will realize moresophisticated value creation and further grow our earning power.

Forward-Looking Response to Changes in the Operating Environment

Even as our business faces a challenging operating environment due to the persistence of low resource and energy prices, we are committed to moving ahead with forward-looking initiatives and carrying out what needs to be done.

Tubular Products Business

—Targeting New Growth Based on Solid Business Foundations Despite Adversity

Sumitomo Corporation's tubular products business boasts worldleading trading volumes for oil country tubular goods (OCTG). As a subarea of this business, we develop OCTG distributor operations that hold a share of approximately 30% in the U.S. oil and gas development market. A broad-ranging customer network has been established through this business.

Fiscal 2015 profits in the tubular products business showed a large decline, as capital investment demand waned in the oil and gas development industry following the sharp drop in the price of crude oil that began in fall 2014. We cannot anticipate a rapid recovery in the oil price, which means we should expect to face a challenging operating environment for a while.

To cope in this environment, we continue striving to enhance the constitution of this business by efficiently utilizing assets and building lean structures. For example, we endeavored to curtail inventories, effectively cutting them down by 40% from peak levels in a little over one year. We also reorganized the Group's OCTG distributor operations in the United States to realize more efficient business operation. At the same time, we will prepare for the eventual recovery of the crude oil price by advancing growth strategies that emphasize the use of our global OCTG customer network, a key strength of Sumitomo Corporation, to explore business peripheral to tubular products.

Specifically, we will go beyond simply supplying customers with OCTG to provide value based on the various needs that arise throughout OCTG life cycles. For example, focused primarily on major customers with long-term contracts, we will offer services ranging from well design consulting to field engineering. In addition, we will further expand our material procurement from OCTG to other related oilfield equipment.

As tubular considers new investments, we will engage all the diverse resources available within Sumitomo Corporation so that any candidate investments are given full consideration by a multifaceted, Companywide project team. This will allow us to examine any new investments from multiple perspectives and ensure we are carefully evaluating the operating environment.

Ambatovy Nickel Project

—Aiming to Maintain Highly Efficient, Stable Operations and Enhance Profitability

Demand for nickel is rising worldwide as it is used in a broad range of materials, such as stainless steel, specialty steel, and battery materials. To cater to this growing demand, in 2005 Sumitomo Corporation participated in a project in Madagascar tasked with integrating processes from the extraction of nickel oxide ores through to metal production. Since then, we have been proceeding with development of the project, which is expected to have a long operational life of almost 30 years and is one of the largest nickel projects in world.

We are developing the project with our partners, Canadian resource company Sherritt International Corporation and Korean state-owned resource company Korea Resources Corporation (KORES). Further, we have taken environment-friendly measures, including a range of programs to preserve forests and protect plants and animals. The project began commercial production in January 2014 and achieved financial completion in September 2015. In the same month, nickel metals that the project produces received approval for registration on the London Metal Exchange.

Fulfilling our obligation to trade the project's products, we are developing nickel metal sales networks not only in Japan but also in Europe, other parts of Asia, and the United States. So far, we have sold out all products received.

While proceeding with construction and start-up of the project, we revised the forecast of the medium-to-long-term nickel price in light of the worldwide fall in resource prices. As a result, in the third quarter of fiscal 2015, we recognized impairment losses of ¥77.0 billion. Currently, we are facing extremely challenging external conditions.

However, we are continuing to work with our partners to maintain highly efficient, stable operations and promote cost reduction initiatives. Thanks to these efforts, in fiscal 2015 we succeeded in reducing costs significantly year on year. We intend to continue those efforts with a view to realizing cost-competitiveness that will place the project as the world's top 25th-percentile nickel producers.

Project Summary

- Total project cost: US$7.2 billion

- Annual production capacity: Nickel: 60,000 tons; Cobalt: 6,000 tons

- Shareholders: Sherritt International Corporation: 40%; Sumitomo Corporation: 32.5%; Korea Resources Corporation (KORES): 27.5%

- Sumitomo Corporation's exposure: Approx. US$1.7 billion (As of March 31, 2016)