Jul. 03, 2018

Sumitomo Corporation

Formation of second fund targeting U.S. properties for Japanese institutional investors

Through its wholly-owned subsidiary Sumisho Realty Management Co., Ltd. (head office: Chuo-ku, Tokyo; President: Hideki Yano; hereinafter, “SRM”), Sumitomo Corporation (head office: Chuo-ku, Tokyo; Representative Director, President and Chief Executive Officer: Masayuki Hyodo) has completed the formation of the U.S. Prime Office (USPO) Fund II, an approximately USD 245 million closed-end private real estate fund allowing selected Japanese institutional investors to invest in specified real estate in the United States. The USPO Fund II is the second fund in the USPO Fund Series, the first of which was launched in June 2017 as the USPO Fund I.

Influenced by the recent low interest rate environment in Japan and the globalization of investment, Japanese institutional investors are becoming increasingly interested in investment in real estate in the U.S. market, the largest real estate market in the world. Through SRM, a licensed placement agent in Japan, the USPO Fund II provided selected Japanese institutional investors an opportunity to invest in the Atlanta Financial Center in Atlanta, Georgia, which prior to the formation of the USPO Fund II was owned by Sumitomo Corporation of Americas (headquarter: New York, the United States; Representative: Shingo Ueno; hereinafter, “SCOA”). As the fund’s investment is in a specified property, institutional investors can more readily evaluate their investment risk. SCOA will manage the property as a service provider, leveraging its property management know-how in the United States.

Sumitomo Corporation has been engaged in investing and managing office properties in the United States for over 36 years, since 1982, when SCOA first acquired an office building in New York’s borough of Manhattan. Starting from the country’s largest metropolis, we expanded our office property investment activities to other major U.S. cities, such as Los Angeles, San Francisco, Washington D.C., and Phoenix. Our current portfolio includes properties in Atlanta, San Diego, Chicago and Miami, including properties under the USPO Fund I and II.

Sumitomo Corporation’s real estate funds and REIT business includes total assets managed through SRM valued at approximately 390 billion yen, including U.S. properties. We intend to continue acquiring premier assets. We remain committed to promoting the USPO Fund series to allow Japanese institutional investors opportunities to invest in U.S. real estate and will seek to continue to expand holdings of high-quality office properties.

Through the USPO Fund series, Sumitomo Corporation will take advantage of the expertise and know-how we have acquired in the U.S. real estate market to provide tenants with high-quality office environments that contribute to their creative and productive activities. Moreover, Sumitomo Corporation will provide Japanese institutional investors with optimal solutions and attractive investment opportunities while contributing to the development of the U.S. real estate investment market.

Reference

■Atlanta Financial Center

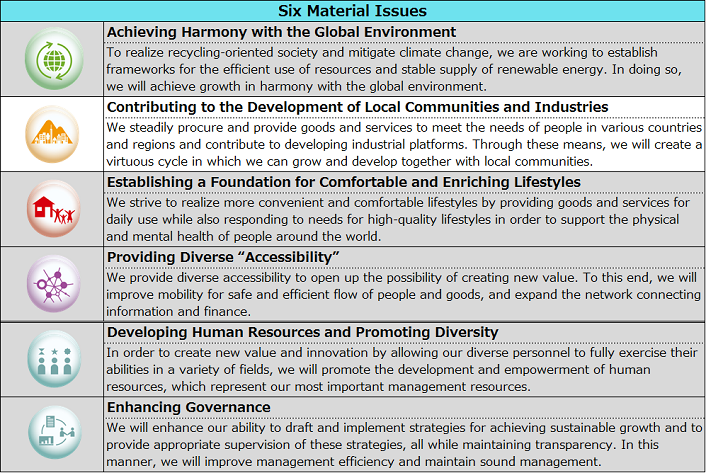

■ Sumitomo Corporation’s Material Issues

Sumitomo Corporation Group positions “Six Material Issues to Achieve Sustainable Growth with Society” as an important factor in developing business strategies and in the decision-making process for individual businesses. Going forward, we will pursue sustainable growth by resolving these issues through our business activities. This project especially contributes to “Contributing to the Development of Local Communities and Industries.”

- Inquiries

- Corporate Communications Department, Sumitomo Corporation

- News Release Contact Form