Action to Implement Management that is Conscious of Cost of Capital and Stock Price (Update on July 31, 2025)

Analysis of Current Situation

- We believe that if we can consistently achieve an ROE of 12% or higher, our profitability will exceed the cost of capital and create Economic Value Added (EVA), while there are various methods for calculating the cost of capital.

- Based on this recognition, by accelerating business portfolio transformation as outlined in our Medium-Term Management Plan 2026 (April 2024 - March 2027), we aim to maintain an ROE of 12% or higher and strive to achieve sustainable improvements of our corporate value. In FY2024, we exceeded our initial plan and recorded a consolidated net income of ¥561.9 billion, with ROE of 12.4%.

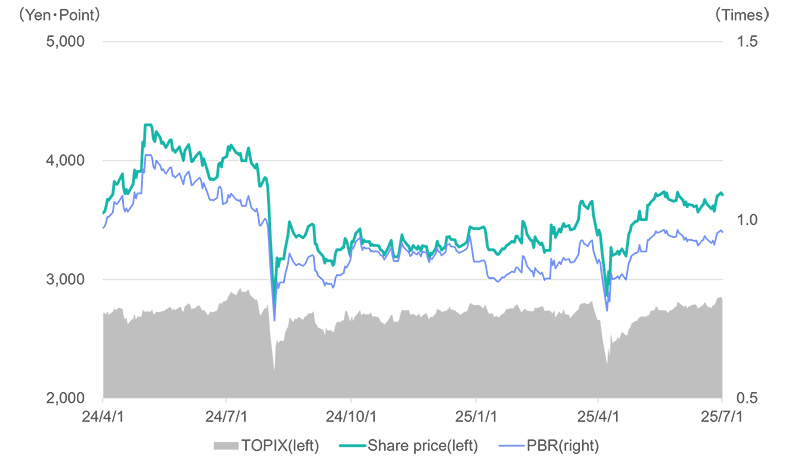

- Since the beginning of FY2024, our stock price temporarily declined sharply due to global stock market downturns in August 2024 and April 2025, but it has remained generally within a flat range.

- Our PBR, which had fallen below 1x since the sharp stock price drop in August 2024, is currently on a recovery trend.

Initiatives

To further improve our stock price and PBR, we will steadily implement the following initiatives and demonstrate stable profit growth as actual results, thereby striving to further earn the trust of the market.

- The theme of Medium-Term Management Plan 2026 is “No.1 in Each Field”. To enhance our competitive advantages to achieve growth through addressing social challenges, we accelerate business portfolio transformation and generate returns that exceed the cost of capital. For that purpose, we focus on “Growth leveraged by strengths” and “Strengthening the driving force for growth”.

- Specifically, under the organizational structure based on Strategic Business Units (SBUs), we will utilize business-specific ROIC and WACC*, and promote business restructuring, including the replacement of low-profit assets. At the same time, by prioritizing the allocation of management resources to growth businesses with strengths and competitive advantages, we will establish earning pillars that drive profit growth, thereby further expanding our earnings base and improving the stability of our profits.

- From FY2024 and beyond, we intend to implement shareholder returns with a total payout ratio of 40% or higher, including progressive dividends and share repurchases in a flexible and agile manner. We will continue to allocate management resources appropriately to shareholder returns and growth investments from the perspective of sustainable enhancement of corporate value, while maintaining financial soundness.

- Furthermore, we will enhance disclosure and strive to engage in constructive dialogue with market participants so that the track record and details of these initiatives can be fully understood.

* ROIC: Return on Invested Capital, WACC: Weighted Average Cost of Capital