Nov. 08, 2023

Sumitomo Corporation

Launch of Accelerator Program in Africa in Collaboration with Safaricom and M-PESA Africa- Expand digital financial services in Africa and build a new digital economic zone -

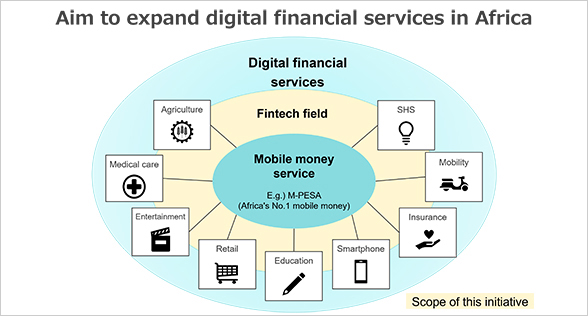

Sumitomo Corporation is launching an accelerator program (Note 1) (hereinafter, the "Initiative") primarily targeting the fintech field, jointly with Safaricom Plc (hereinafter, "Safaricom"), which is the number one telecommunications operator in Kenya and affiliated with the Vodafone Group, and M-PESA Africa Limited (hereinafter, “M-PESA Africa”), which is a joint venture by Safaricom and Vodacom Group Limited and a leading fintech and payments company providing varying solutions to different markets on the African continent (hereinafter collectively, the “Three Companies”). It is said that more than 1,000 startups are born every year in Kenya, and many of them are in the fintech field due to the high need for financial services and the high penetration rate of mobile money. Through the Initiative, the Three Companies will discover excellent startups, jointly create new businesses, and aim to build a new digital economic zone in Africa, which has attracted increasing attention as a part of the Global South in recent years.

| (Note 1) Accelerator program | : | A program to accelerate growth by providing the know-how necessary for new business creation, product development and funding to early-stage startup companies with innovative technology and business models. |

| (Note 1) Accelerator program | : | A program to accelerate growth by providing the know-how necessary for new business creation, product development and funding to early-stage startup companies with innovative technology and business models. |

Payment situation in Africa

One of the challenges in the financial services industry in Africa is that there are many people who are unable to obtain credit and access financial services because their income is not stable, even if they have a certain level of income. This is often coupled with the fact that the convenience of payment is extremely low due to the lack of a widespread banking network. In recent years, with the expansion of communication infrastructure and the use of tech data, it has become possible to use financial services (installment sales, etc.) using fintech, in addition to payments and remittances using mobile money. In fact, in Kenya, M-PESA (a mobile money service provided by Safaricom and other affiliate companies in Africa) is a key enabler of financial services and has become a ubiquitous tool for making payments in people's lives.

Aim of the Initiative

Safaricom is the largest telecommunications carrier in Kenya with over 45 million customers. The company, together with Sumitomo Corporation and other partners, is a member of the consortium that owns Safaricom Ethiopia, a comprehensive telecommunications company in Ethiopia. M-PESA Africa provides Africa's largest mobile money service, used by 60 million people in eight African countries.

By combining these strong business foundations (in communications, mobile money, financial services, etc.), Sumitomo Corporation’s wide range of business experience and the products and services of cutting-edge startups that we will encounter through the Initiative, Sumitomo Corporation will create innovative businesses, support the expansion of the startup market and provide highly convenient services to more people. Furthermore, Sumitomo Corporation will expand digital financial services in Africa, particularly in areas such as e-commerce, insurance, education and entertainment.

Through the Initiative, the Three Companies will contribute to the development of the African economy, human resource development, and the realization of a more prosperous life for the people, by continuing to build a new digital economic zone in Africa.

Collaboration between Sumitomo Corporation and Vodafone in the communications and digital fields

Sumitomo Corporation and Vodafone Group Plc (hereinafter, "Vodafone"), a major UK telecommunications operator, entered into a strategic partnership in November 2020, and agreed to jointly advance business, mainly in the telecommunications and fintech fields in Africa. In 2021, as the first step in our collaboration, we together with other partners and through Safaricom Ethiopia acquired Ethiopia's first private telecommunications operator license. The business began full-scale operation in October 2022. In the second step of our collaboration, we invested in DABCO Limited (DABCO), a subsidiary of Vodafone in August 2023. DABCO operates the digital platform "PAIRPOINT" (Note 2), which allows devices to communicate with each other using SIM cards and conduct transactions such as payments. Also, in May 2023, we made an additional investment in M-KOPA holdings Limited (M-KOPA), which operates digital financial services using mobile money in the sub-Saharan region of Africa and are jointly promoting M-KOPA services in countries and regions where Vodafone operates businesses.

The Initiative is the third step of our collaboration with Vodafone. We will continue to bring together our respective business foundations and know-how and consider collaborations primarily in Europe and Africa, working to develop local communities and economies and resolve social issues.

| (Note 2) PAIRPOINT | : | The brand name of the digital platform was changed from "Digital Asset Broker" to "PAIRPOINT " in October 2023. |

| (Note 2) PAIRPOINT | : | The brand name of the digital platform was changed from "Digital Asset Broker" to "PAIRPOINT " in October 2023. |

Overview of each company

■Safaricom Plc

| Location | : | Nairobi, Kenya |

| Establishment | : | 1997 |

| CEO | : | Peter Ndegwa |

| Shareholders | : | Vodafone Kenya Limited, Kenyan Government, Free Float |

| Business | : | Comprehensive telecommunications services with a focus on mobile phones |

■M-PESA Africa Limited

| Location | : | Nairobi, Kenya |

| Establishment | : | 2019 |

| CEO | : | Sitoyo Lopokoiyit |

| Shareholders | : | Safaricom Plc、Vodacom Group Limited |

| Business | : | FinTech, mobile payments and money transfer services |

Related Information

- Investment in M-KOPA Holdings Limited, the leading 'pay-as-you-go' solar and finance platform

- Vodafone and Sumitomo Corporation Announce Strategic Alliance

- Global Partnership for Ethiopia welcomes licence award to operate telecom services in Ethiopia

- Launch of telecommunications services in Ethiopia

- Investment in DABCO, UK-based Digital platform provider for connected devices

- Capital increase for M-KOPA, a digital financial services company in sub-Saharan Africa