- TOP

- Enriching+TOP

- Sumitomo Corporation Corporate Venture Capital (CVC): Founding Members Discuss Working With Trading Company-Affiliated Startups (Part 2) Sumisho Venture Partners make good on their word working with startup "tsukurioki.jp"

2024.8.7

Business

Sumitomo Corporation Corporate Venture Capital (CVC): Founding Members Discuss Working With Trading Company-Affiliated Startups (Part 2)

Sumisho Venture Partners make good on their word working with startup "tsukurioki.jp"

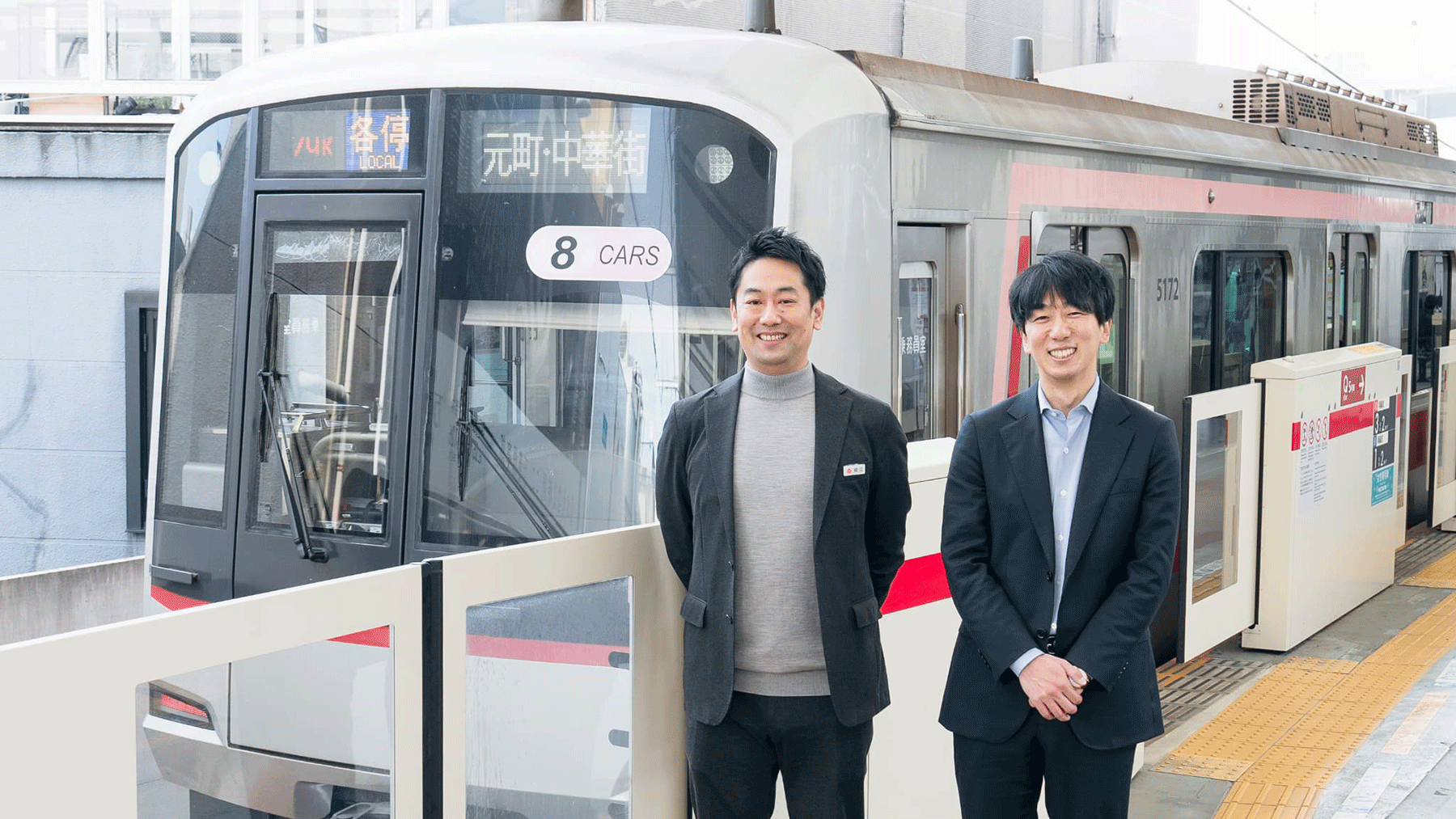

Sumisho Venture Partners (SVP) was established in April 2022 as the domestic Corporate Venture Capital (CVC) arm of Sumitomo Corporation. In the first installment of this series, founding members talked about the company's management philosophy among other topics, and the role of "business producer" was mentioned as one of SVP’s strengths. But what does being a "business producer" entail? In this second installment, we spoke from Shohei Akiba, SVP Investment Associate, and Kei Maejima, President and CEO of Antway, an SVP portfolio company.

-

Investment Associate, Sumisho Venture Partners

Shohei Akiba

After joining Sumitomo Corporation in 2019, Shohei worked in the Media and Digital Business Unit, where he was involved in the full spectrum of activities, including strategy planning, performance management, public relations and IR operations. Since July 2022, he has overseen global CVC management and business development of SVP in the Innovation and Investment Department. He has been in his current position since June 2023.

-

President and CEO, Antway Inc.

Kei Maejima

Kei joined Recruit as a new graduate in 2016, where he gained experience overseeing the development of new insurance-related services, overseeing the development of beauty booking services, and launching new businesses. In 2018, he left Recruit and founded Antway.

- Synergy With SVP Anticipated by Fast-Growing Startup

- Making the Most of Our Network With Major Companies to Propose B2B Business

- Working To Overcome Misalignment – Sharing the Momentum for Ongoing Business Development

- From Supply and Demand To Aiming For an IPO – SVP Support Helped Build the Business

Synergy With SVP Anticipated by Fast-Growing Startup

We'd like to begin by asking how SVP came to invest in Antway.

AkibaMy first encounter with Antway came via a referral from another venture capitalist (VC). Seeing the potential in the "tsukurioki.jp" service operated by Antway, SVP invested in the company in May 2023.

Maejima"tsukurioki.jp" is a home delivery service that provides refrigerated food prepared by professionals under the supervision of a registered dietitian every week. For around 700 yen per meal, the service provides everything needed to make dinner for you every day. The primary aim of the service is to reduce the burden of housework on a growing number of dual-income households and households raising children.

Akiba What caught SVP's attention was the fact that "tsukurioki.jp" was outclassing by a wide margin other similar services in the direct-to-consumer (DTC) market in terms of customer satisfaction and acquisition channel efficiency. We considered this as an indication of the high latent need among working households, burdened by a lack of time and the stress that comes with meal preparation.

Our decision was also supported by high praise we received from "tsukurioki.jp" users within Sumitomo Corporation and the excellent quality of the products we tasted.

What did Antway expect from SVP?

Maejima SVP invested in Antway during the Series C(*1) round. With a steadily growing customer base, Antway was looking to further raise its visibility while taking on challenges throughout the value chain, including nationwide food procurement.

As the CVC of an integrated trading company, SVP has knowledge in the procurement and sales of foodstuffs. In addition, the Sumitomo Corporation Group has many wide-reaching assets, including the Summit supermarket and other retail businesses, so we had high hopes that the company would generate synergies quite different from that offered by independent VCs.

(*1) In the investment rounds of a startup, the Series C is a stage when the startup has a stable profitable business and is aiming for an exit (to recoup its investment in a venture business or corporate revitalization) such as an IPO (Initial Public Offering) or M&A.

Making the Most of Our Network With Major Companies to Propose B2B Business

Following the investment, SVP pitched the idea of corporate services to support Antway's business development, starting with the introduction of "tsukurioki.jp" as a service for employees at Sumitomo Corporation. What were you aiming for with this proposal?

AkibaStartups inevitably have limited resources and personnel, which can hinder their ability to raise brand awareness, so our aim was to lend Antway support in this area. Since Antway had been focusing on DTC sales, SVP presented a plan to expand into the B2B realm, taking advantage of its strengths in networking and sales to major corporations. This led us to believe that an employee benefit-type service that sold directly to large companies with many dual-income household employees would be the best fit.

How did SVP and Antway communicate during the business development process?

Akiba When we started discussions on how to develop the B2B business, we held regular weekly meetings involving SVP, Antway and the Food SBU, a department that handles all aspects of food and food products at Sumitomo Corporation. Product design details, including ideas on customer pickup and how to appeal to potential users, and whether to use company cafeterias, individual home delivery or storage in company refrigerators, were other questions discussed outside of these meetings.

Antway is a fast-growing startup. Since conditions change on a daily basis, it remains important to keep close tabs on progress on both sides.

Working To Overcome Misalignment – Sharing the Momentum for Ongoing Business Development

Did you encounter any challenges or difficulties in the process of developing the business?

Akiba Initially, there was some conflict between the issues that Antway was looking to solve and the issues SVP wanted to address.

Maejima SVP wanted to help raise awareness of "tsukurioki.jp" through B2B development, but Antway was facing an urgent issue: variations in customer demand depending on the day of the week. Monday pickup was the most popular, while pickup slots later in the week were usually left open.

How did you reconcile these misaligned priorities?

AkibaBecause we believed that achieving B2B expansion was essential to the growth of the business, we proceeded with trial sales at Sumitomo Corporation concurrently, mindful of the low-demand days issue that Antway was looking to resolve. We felt that both aims could be achieved with a little ingenuity and had a series of discussions. Specifically, we designed the service to attract more customers on low-demand days by checking Antway's manufacturing capacity on a weekly basis and changing the rates for low- and high-demand days. Although demand exceeded supply for some pick-up slots, Antway's manufacturing capacity gradually increased, leading to B2B expansion.

Maejima In the end, the initiative made a lot of sense as measures were taken to overcome both challenges: medium- and long-term channel development and short-term low-demand days of the week.

AkibaIn practice, the business development process tends to slow when there are initial differences, with people saying things like, "Let's wait a while," but we tried to keep up the momentum.

Maejima Startups generally face challenges and problems, and only rarely succeed. Given this, unless you share the momentum of working together to overcome the challenges, the project will go up in smoke before it ever gets off the ground. Our regular weekly meetings were critical to maintaining the high levels of enthusiasm needed to get us through, and we remain very thankful for them.

Is this ability to accomplish goals a strength that differentiates SVP from other VC firms?

Maejima I believe that SVP's strength lies in the ability to make good on its promises. I spoke to around 100 VC firms, including several that expressed an interest in investing in Antway, and I must say that SVP's ability to walk the talk is, without exaggeration, the best in the VC industry.

At first, we thought it would be nice to generate a single example of co-creation, but SVP are now supporting us not only in the area of corporate welfare services but also in franchise operations, with the goal of expanding our manufacturing capacity; everything is being tackled with a great sense of urgency.

From Supply and Demand To Aiming For an IPO – SVP Support Helped Build the Business

You mentioned manufacturing support earlier. Please tell us about the business development initiatives that SVP and Antway are currently working on, and your outlook for the future.

Maejima We are looking to receive support in all areas, including sales for B2B expansion, ingredient supply when demand expands in the future, and overseas expansion down the line. Through the SVP's support, we are committed to further increasing the number of manufacturing partners through franchise development.

Akiba SVP's approach is not limited to investment: as a member of a trading company, we work with startups directly in building their business. We believe the work we are accomplishing with Antway will be of great value to the company as it works towards an IPO, and we hope to continue to accompany them on their journey.