- TOP

- Enriching+TOP

- Corporation Corporate Venture Capital (CVC): Trading Company Challenges in Supporting Startups and Entrepreneurs (Part 1)

2024.7.22

Business

Corporation Corporate Venture Capital (CVC): Trading Company Challenges in Supporting Startups and Entrepreneurs (Part 1)

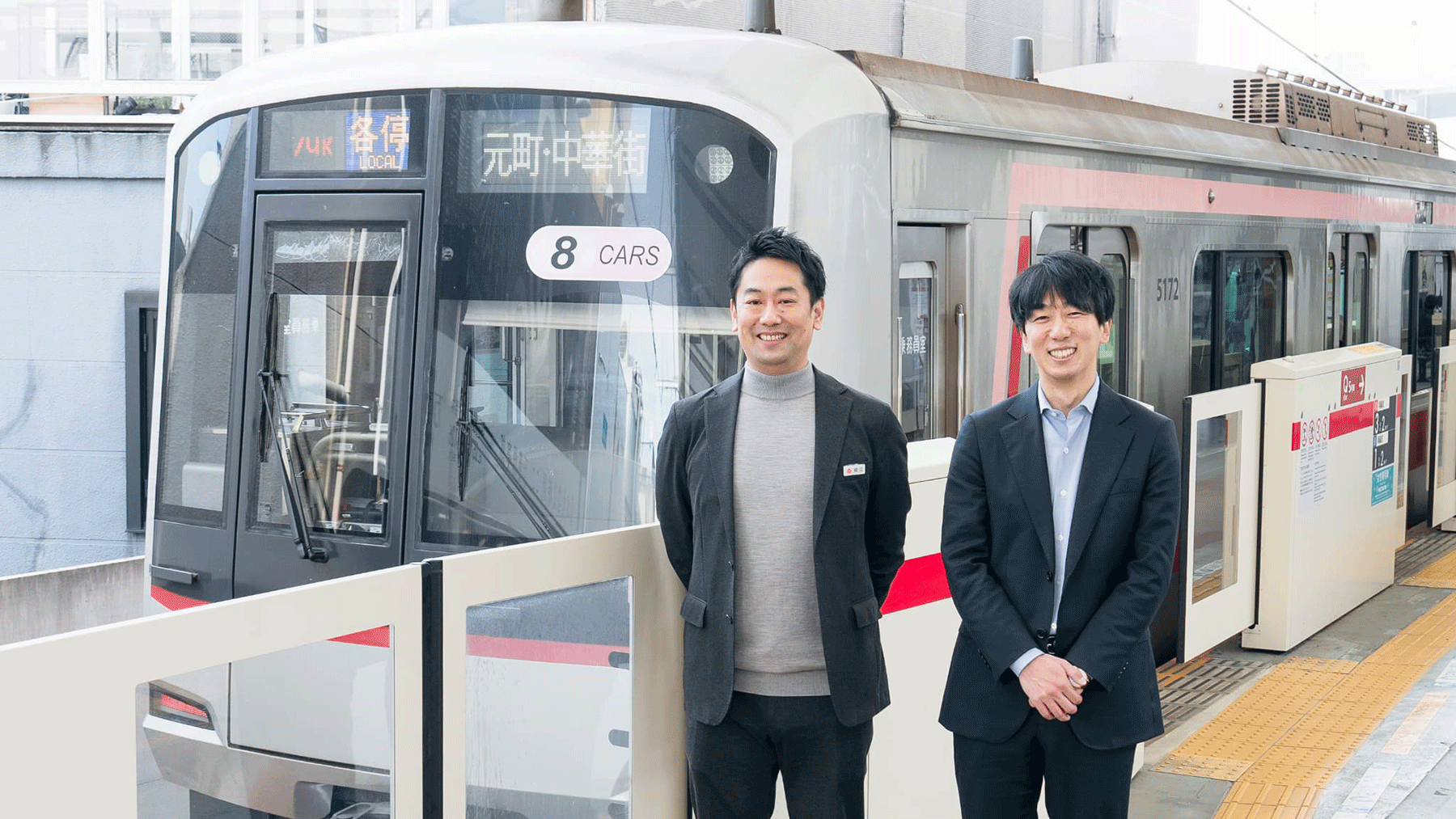

Sumisho Venture Partners (SVP) was established in April 2022 as the domestic Corporate Venture Capital (CVC) arm of Sumitomo Corporation. Leveraging Sumitomo Corporation's existing assets, SVP invests in startups across a wide range of industries, including next-generation energy, social infrastructure, retail, healthcare and agriculture. In this two-part series, we examine the value and benefits that SVP offers. For this installment, we interviewed founding SVP members, President and CEO Hidehiro Yamaki and Senior Associate Shogo Minami, about the values underpinning SVP and its vision for the future.

-

President and CEO, Sumisho Venture Partners

Hidehiro Yamaki

After working in business investment, CVC and trading in the IT and life science fields at a major integrated trading company, Yamaki worked in venture capital and fund investment at a government fund. Later, he oversaw new business development at a major advertising agency. He joined Sumitomo Corporation in 2019, and assumed his current position in April 2022.

-

Senior Associate, Sumisho Venture Partners

Shogo Minami

Minami joined Sumitomo Corporation in 2020 as a new graduate. While in the Innovation & Investment Department, he worked on investment management for Presidio Ventures, a U.S. venture capital company, and Sumitomo Corporation Equity Asia, a Chinese venture capital firm. He also supported Sumitomo Corporation portfolio companies expand into Japan. He assumed his current position in April 2022. His interests include analyzing startup trends.

From Investment to Sales – Our Strength is Making Good on Developing Businesses and Utilizing Assets

Sumisho Venture Partners, a CVC that invests in startups in Japan, was established in 2022. Can you give us some background and an overview of SVP’s business?

YamakiSumitomo Corporation has been involved in CVC for many years, beginning with the launch of Presidio Ventures in Silicon Valley in the United States in 1998. Since then, we have set up CVCs in China, Israel and the United Kingdom, and have invested in more than 300 startups globally. The number and value of domestic startups began increasing in the 2010s, and as the market environment improved, there was a growing sense in Japan that a dedicated unit for domestic startup investment was needed. Originally, Sumitomo Corporation invested in different companies in Japan as a trading company, but startup investment is a whole different story.

MinamiThe size of a single investment ranges from 50 to 200 million yen. Investment stages are mainly Series A(*1) and onward, but we also handle some seed funding.(*2) Our investments cover a wide range of business areas, including DX, retail consumer, agri-food, next-generation energy, healthcare and social infrastructure. We are truly a comprehensive company, and I believe our strength lies in the fact that we are an integrated trading company with a diverse range of businesses.

(*1) One of the stages of investing in a startup. This is the stage when a product or service is launched, and a full-fledged business begins operating.

(*2) At this stage, the general framework of the business has been established, but the specifics of the product/service and sales method have yet to be determined, and a working prototype is in development.

What value and advantages do SVP offer?

YamakiWe have two major advantages. The first is that we are a "business producer." Second, we offer the global network and diverse assets of the Sumitomo Corporation Group.

What do you mean by "business producer?"

YamakiSVP is a relative newcomer to the CVC market, so without any reputation or track record, I think we can create a niche for ourselves by "creating business together," a characteristic that is unique to trading companies. We are a "business producer" in that we seek new clients for startups and propose new businesses they can't undertake on their own.

I have considerable experience in the venture capital (VC) industry, including CVC at operating companies and public-private funds, but it is rare to find a CVC that also handles business development. There are many CVCs that give presentations and say, "Let's do this," but it's important to go beyond just words, working together with the client to develop the business, including the sales and marketing process.

When the decision was made to invest in Nudge, a next-generation co-branded credit card provider, all SVP employees worked together to market the credit cards to over 30 companies during the first six months. Nudgewas an early-stage(*3) investment, when nothing could get off the ground without sales. Also, by working together, we made many discoveries that wouldn't have been possible through analysis on paper alone. We conduct DD, or due diligence,(*4) when making an investment, but it was a learning experience for us as well, allowing us to preemptively verify our hypotheses, which we wouldn't have been able to do otherwise, until we actually carried the product.

(*3) Pre- and post-startup, the preparatory stage before beginning a fully-fledged business.

(*4) Due diligence indicates investigation into the value, risks, etc. of a target business by a potential investor.

What exactly can the Sumitomo Corporation Group offer in terms of its global network and diverse assets?

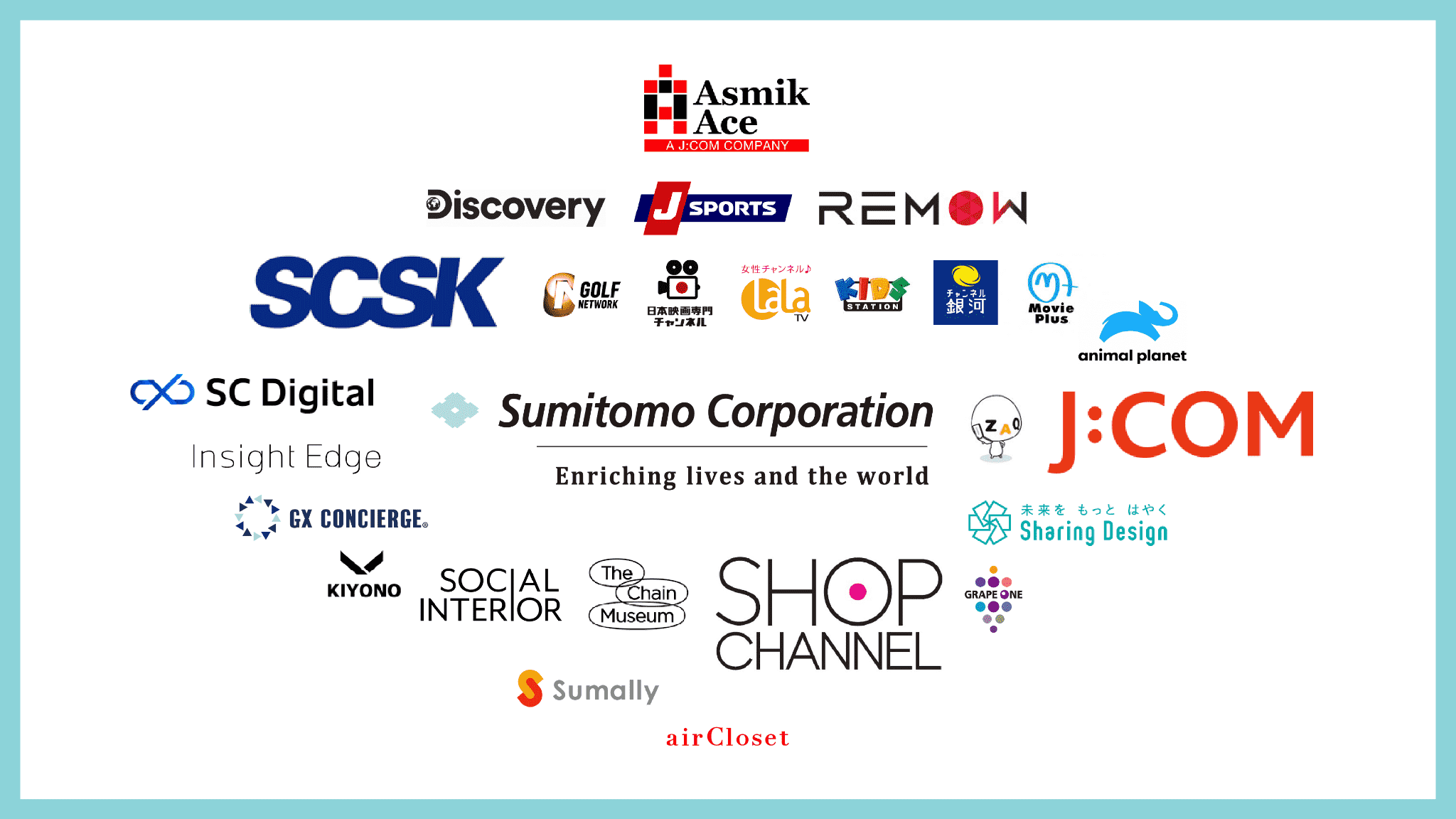

MinamiWith more than 900 group companies in Japan and overseas, Sumitomo Corporation can contribute to the business expansion and overseas development of startups. For example, in addition to media and digital domains such as SCSK and J:COM, we have many operating companies developing retail businesses, including Summit supermarket and Tomod's drugstore, both of which are ventures unique to the Sumitomo Corporation Group.

Trust in SVP Built Through Dedication: Relationships with Investment Partner at the Core

As founding members of the company did you encounter any difficulties when you launched SVP?

YamakiActually, the concept of SVP was not that difficult. We had a clear image from the early stage. I had experience in several startup investments and believed that if we could create a CVC that combines investment skills with the ability to contribute to startups through business development in the style of a trading company, we could establish SVP as a unique player in the startup investment industry in Japan. However, I think that Mr. Minami, who was the only person in charge of the project on the ground, faced a number of challenges.

MinamiFor sure. I was under pressure because the company's reputation depended on my sourcing, or searching out, companies to invest in. To find target businesses, it's important to have a network of VCs, so in the beginning, I focused on building relationships by attending lunches, meeting up for drinks and meetups with VCs. Thanks to these efforts, we began receiving introductions from other VC firms and were gradually able to establish a track record.

A turning point for me personally was when we decided to invest in forest, a company that supports the succession and growth of Ecommercebrands through e-commerce and M&A. On this occasion, I sent a DM to the CEO of forest on social media. At first, he wasn't sure about it, but I was able to develop a relationship based on trust with a startup that I had spotted independently and connect it to investment, which gave me a lot of confidence.

Yamaki What I find amazing about Mr. Minami is his honest approach to everything. I find it interesting, too, that he’s been talking about his love for startups since he first began looking for a job.

MinamiI'm a self-confessed "startup geek." I research startups around the world and analyze trends to the point where the boundary between hobby and work disappears. I get real pleasure from imagining business ideas that I might work on in the future and deepening my understanding of them by talking to VCs and entrepreneurs. That's why I was very happy when an investment partner told me, "I decided to work with SVP because of you, Mr. Minami."

Keen Insight is Paramount – Making Entrepreneurs' Grand Visions a Reality

In a popularity-based survey of Japan’s most innovative major companies of 2024,which covered 1,186 companies, Sumitomo Corporation ranked in the top twenty overall, and first in the trading company category. This suggests that open innovation through collaboration with startups is starting to gain real recognition. Among the businesses you have supported to date, what kind of evaluation and reaction have you received from your portfolio companies?

YamakiIn the two years since SVP was established, we have met with approximately 500 startups and currently have eight investments under our belt.

One comment from the CEO of Sorajima, a webtoon business (digital comics read vertically), was particularly memorable. He said, "While most of the advice was to grow the business steadily, SVP was the only CVC who told us from the outset to aim for the stars by building a bigger business."

The future is already looking bright for SVP, but what do you envision for the company?

YamakiCVC in itself remains an incomplete business model, and there isn't an established pattern of success even when viewed globally. This is why SVP must establish a track record that will be recognized by startups and the industry as a unique business producer, and pursue a future as a "model CVC." We will continue to support entrepreneurs who are striving to identify unresolved issues globally, and who will bring more apt and keen resolutions than we can possibly imagine.

MinamiSVP has a "business producer" policy, but I think it's quite rare to find a CVC that so clearly articulates its commitment to rolling up our sleeves in the process of building a new business. We don't have an extensive track record yet, but if this really starts to take off, we should have a distinct advantage. As a "CVC that invests in startups that pioneer new industries and produces dreams for Japan," our goal is to partner with entrepreneurs that have big dreams and visions and directly create innovation.

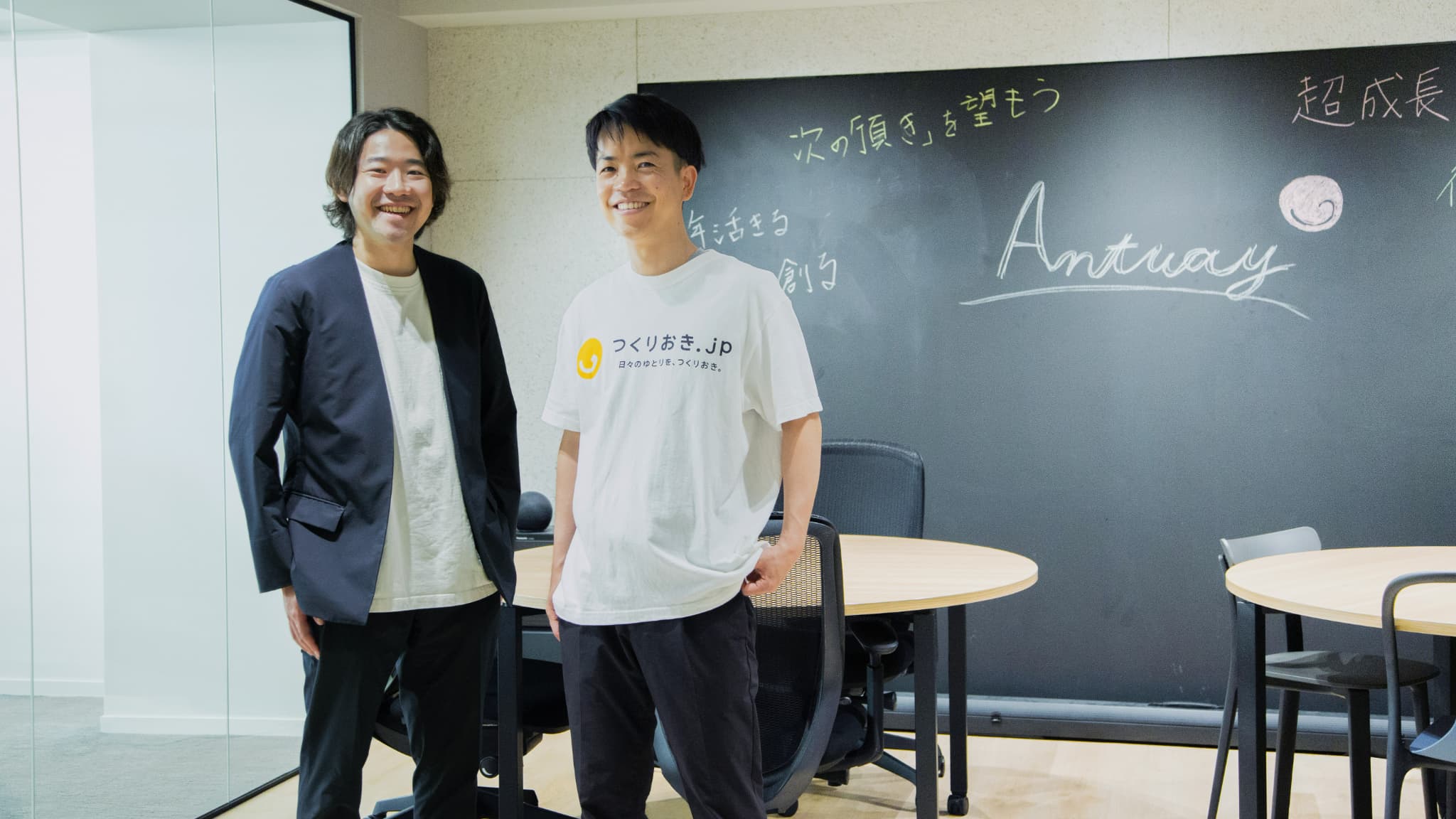

In the second installment of this series, we will hear from Shohei Akiba, SVP Investment Associate, and Kei Maejima, CEO of Antway, a SVP portfolio company, about real-life examples of co-creation.