- TOP

- Enriching+TOP

- Sumitomo Corporation's Soaring Commercial Aviation Business: Powered by the World's Second Largest Aircraft Leasing Operation

2025.8.29

Business

Sumitomo Corporation's Soaring Commercial Aviation Business: Powered by the World's Second Largest Aircraft Leasing Operation

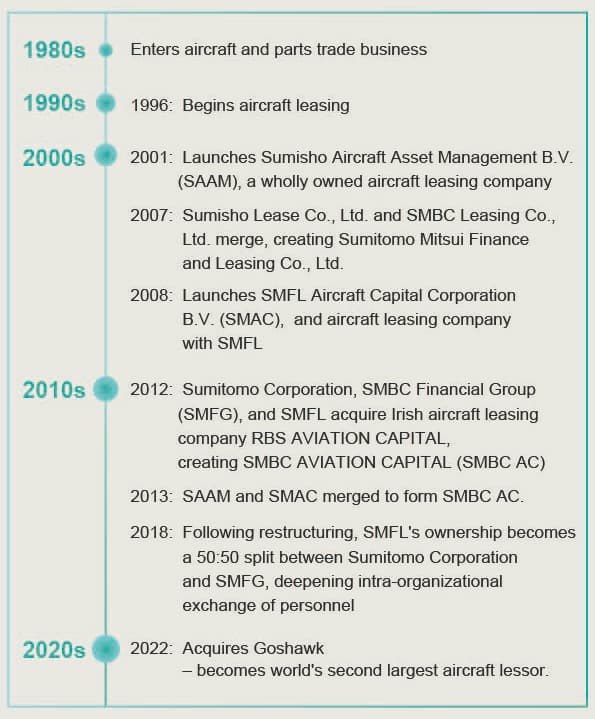

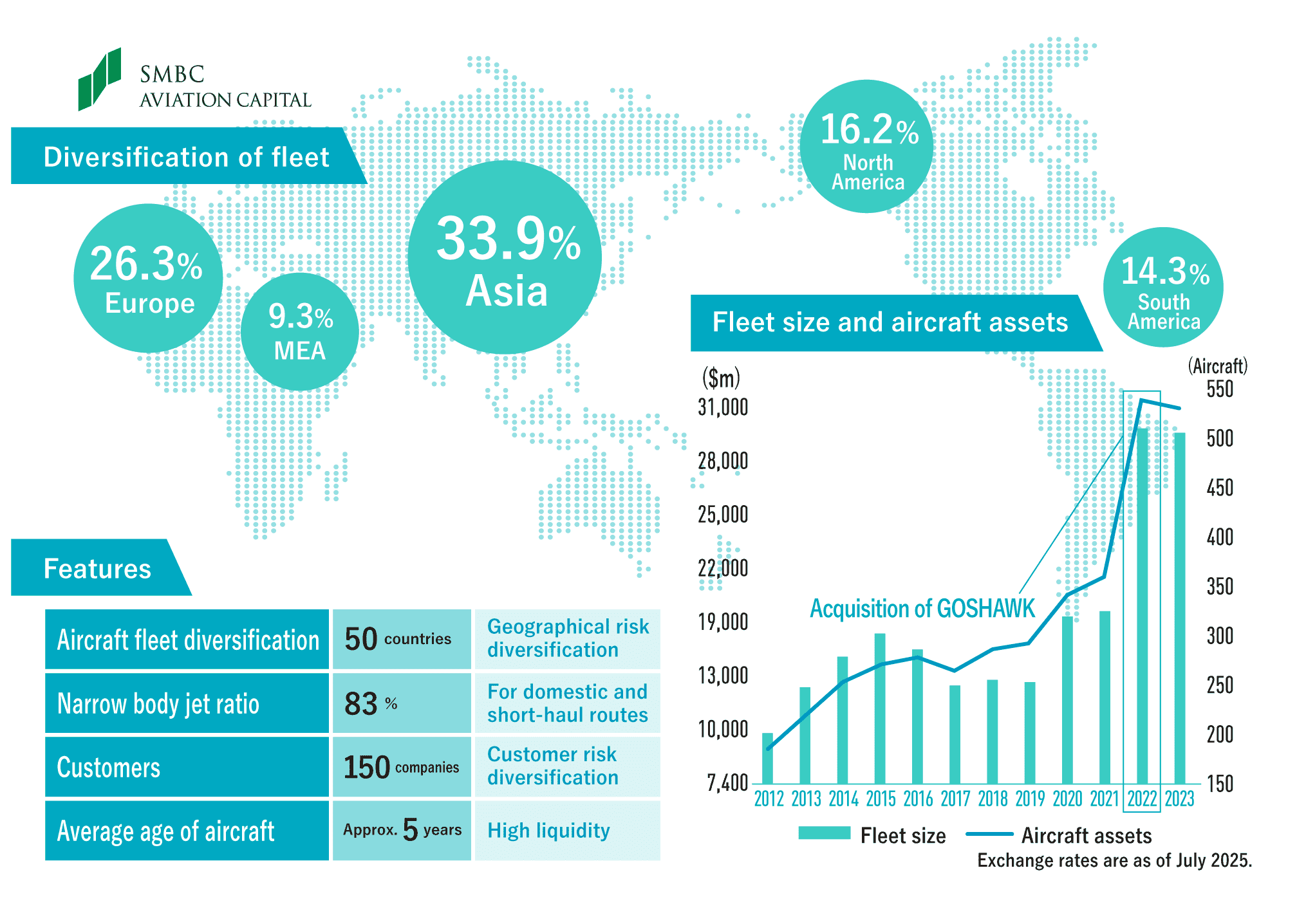

Sumitomo Corporation entered the commercial aviation business in the 1980s, and together with Sumitomo Mitsui Finance & Leasing (hereinafter "SMFL"), has steadily expanded its operations. Today, the company operates globally through its aircraft leasing company, SMBC Aviation Capital (hereinafter "SMBC AC"), boasting the second-largest fleet in the world. Beyond aircraft leasing, it has also taken on new sustainable initiatives, including engine and helicopter leasing, aircraft component reuse and sustainable aviation fuel (SAF) development. Today we're tracing the journey, strengths and future outlook of Sumitomo Corporation's aviation business.

From Trading Activities to Leasing: The Evolution of Sumitomo Corporation's Commercial Aviation Business

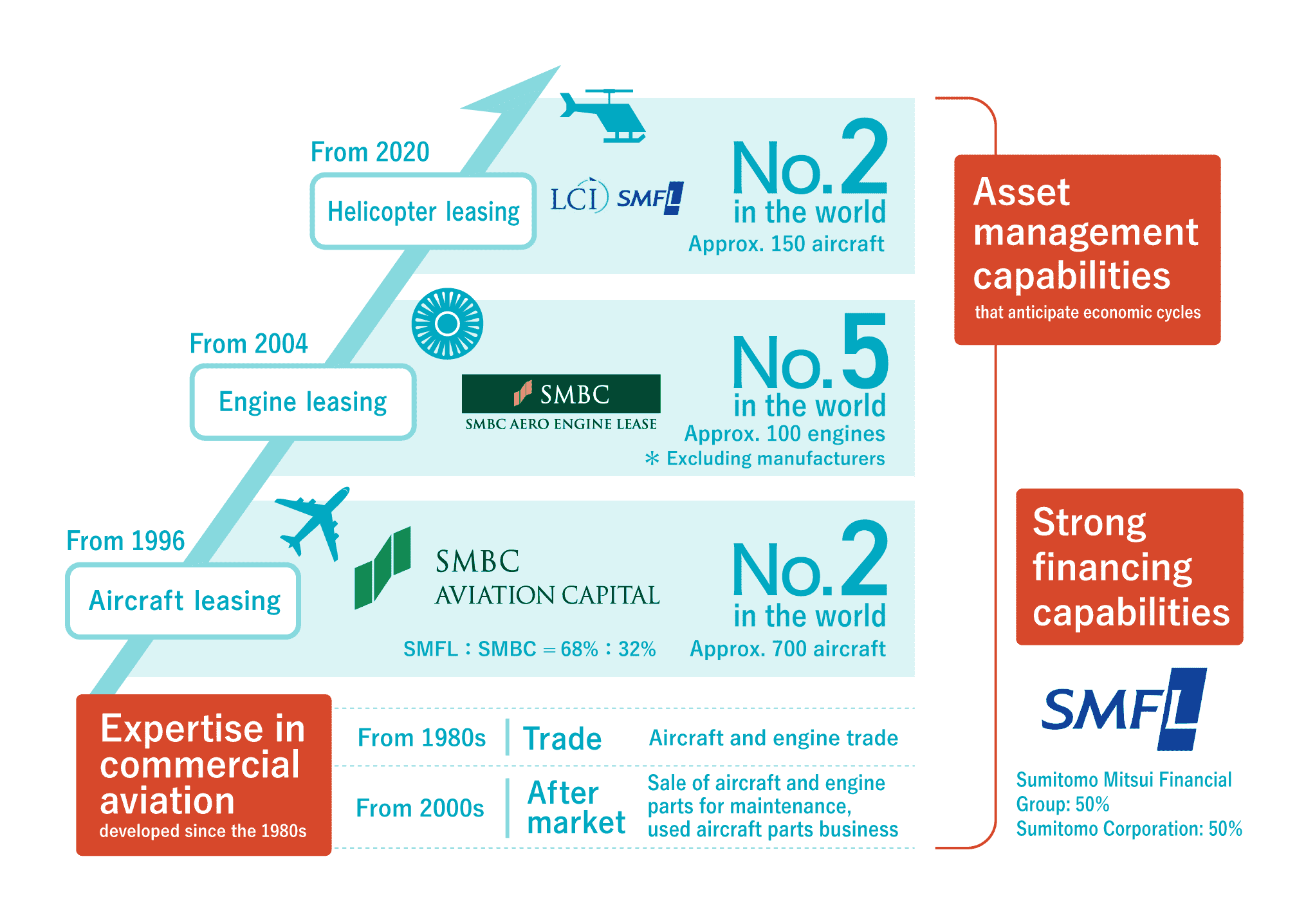

Sumitomo Corporation began in aviation through trading activities in the 1980s and expanded into leasing in the 1990s. From the 2000s onward, it established and acquired leasing companies around the world. In 2012, it joined forces with SMBC and SMFL to launch SMBC AC. Today, the company ranks second among the world's leading aircraft lessors, with a fleet of approximately 700 aircraft. The business also extends into adjacent fields such as engine and helicopter leasing.

Four Reasons Airlines Rely on Leasing

Aircraft leasing, which underpins Sumitomo Corporation's commercial aviation business, now accounts for over 50% of the world's aircraft. Four main factors drive this demand:

●Lower Upfront Costs and Financial Flexibility

Leasing reduces the high initial investment required to purchase aircraft and improves cash flow stability. In addition, because aircraft are traded in USD, leasing minimizes residual value risk and currency risks.

●Flexible Fleet Planning

Due to significant order backlogs and the production capabilities of aircraft manufacturers (as of July 2025), orders placed now for new aircraft, especially narrow-body, won't be delivered until 2030. Leasing enables earlier access to aircraft.

●Cash Generation During Crises

In economic downturns, airlines can secure liquidity by selling aircraft and leasing them back via "sale and leaseback" arrangements.

●Support for Fleet Modernization

With the increasing urgency to upgrade to more fuel-efficient aircraft, leasing plays a key role. Newer aircraft are over 15% more fuel efficient than older models. Promoting the use of newer aircraft is another crucial role leasing companies fulfill.

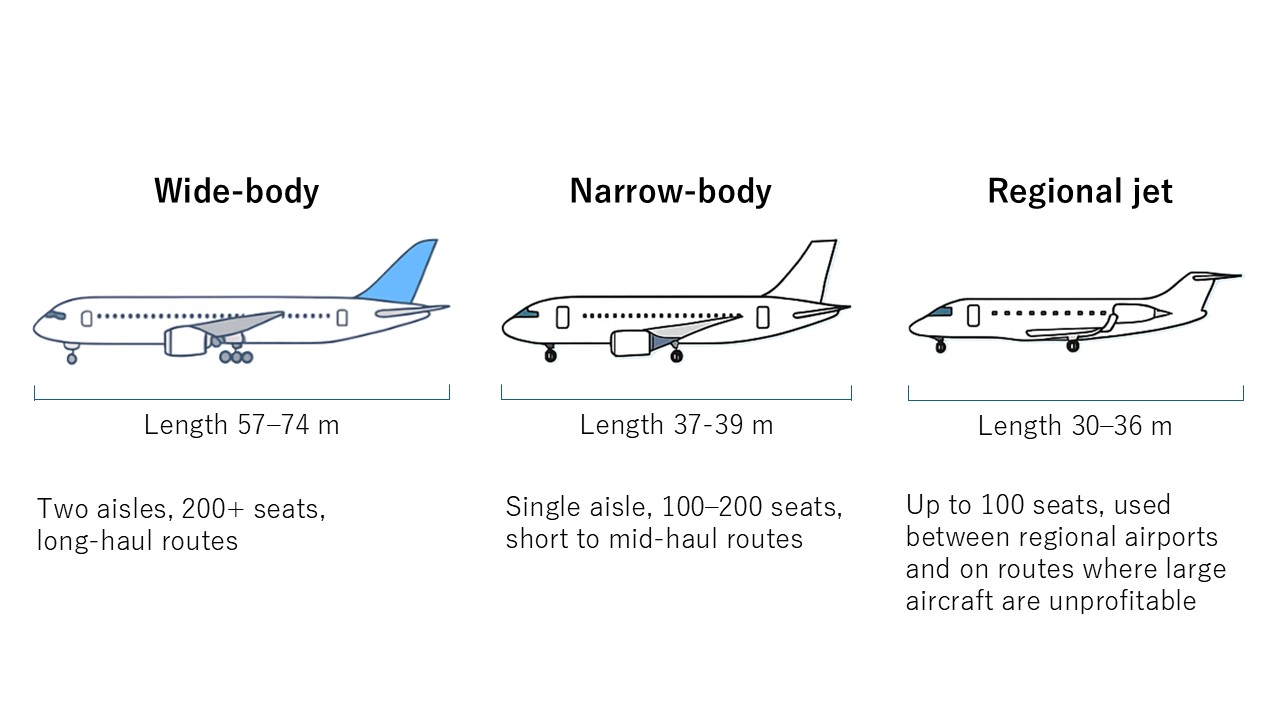

Aircraft leasing allows airlines to adapt fleet composition flexibly in response to market changes – a need that became even more pronounced after the COVID-19 pandemic. While narrow-body jets (single-aisle) recovered first on short- and mid-haul routes, demand for wide-body jets (twin-aisle) on long-haul routes is also rising.

Growth Through Synergy: Sumitomo Corporation, SMFL and SMFG

The success of the aircraft leasing business is rooted in the collaborative efforts of Sumitomo Corporation, SMFL and SMFG. Here's how their unique strengths drive growth.

A key strength lies in SMBC AC's ability in "discerning quality," a vital skill in the aviation industry where knowledge and experience are everything. Given the sector's high volatility – subject to economic swings and sudden global events – accurately assessing the value of assets, particularly aircraft, is essential. SMBC AC maintains strong asset value by keeping the average age of its fleet young. The ability to make shrewd judgments was particularly evident during the COVID-19 pandemic. While many non-financial lessors hesitated, SMBC AC anticipated post-pandemic demand and stepped in, committing capital to acquire a large number of aircraft. That bold decision became a major driver of the company's recent rapid growth.

Another standout capability is its on-the-ground responsiveness, honed through years of experience. SMBC AC currently serves 150 customers across 50 countries, and to mitigate geopolitical risks such as conflict or terrorism, it carefully distributes its aircraft across multiple regions across the globe.

Among the three partners, Sumitomo Corporation’s standout strength as an integrated trading company lies in its ability to build new businesses from the ground up – what it calls its "business development capability." Tapping into its global network of airlines and manufacturers, Sumitomo Corporation has launched numerous joint ventures and partnerships. One prime example is the establishment of SMBC Aero Engine Lease (hereinafter "SAEL"). Aircraft engines require removal and major maintenance every few years, creating demand for spare engines during that downtime. Recognizing this need, Sumitomo Corporation launched the new venture. The company's track record in aviation helped it secure a partnership with MTU Aero Engines, the world's largest independent engine maintenance provider. Its collaboration with MTU enabled it to steadily grow its customer base. The business was later transferred to SMFL – which added its financial strength to the mix – helping the venture grow into the world's fifth-largest engine lessor (excluding engine manufacturers), with over 100 engines owned and under management.

Sumitomo Corporation's business development capabilities have also played a key role in its helicopter leasing operations. A 2018 restructuring brought SMFL's ownership ratio with Sumitomo Corporation and SMFG to a 50:50 split, strengthening their business alliance. In 2019, SMFL launched a dedicated Aviation Business Development Dept, which allowed Sumitomo Corporation's development expertise and SMFG's financial muscle to work together seamlessly – from business inception to scaling up. The division's first major project was helicopter leasing. In 2025, through SMFL, they acquired the world's second- and third-largest helicopter lessors in quick succession. Their fleet now exceeds 300 helicopters, placing them on the cusp of becoming a global market leader. While demand for fixed-wing aircraft plummeted during the pandemic, helicopter demand actually rose – driven by needs in emergency medical transport and rescue missions. This business not only responded to a pressing societal need but also helped diversify the portfolio, providing a hedge against market risk.

Across the Entire Aircraft Lifecycle: Taking on SAF and the Aftermarket Business

Looking ahead, SMBC AC and the Sumitomo Corporation Group continue to take on new challenges in line with the global goal of achieving carbon neutrality by 2050. Two key pillars of these efforts are sustainable aviation fuel (SAF) and the aircraft aftermarket. Recognizing SAF as a crucial component for decarbonizing the skies, Sumitomo Corporation is pursuing opportunities across the full value chain – from upstream production, to midstream logistics and airport distribution, and finally downstream in sales to airlines – leveraging its broad capabilities as an integrated trading company.

The Group is also strengthening its presence in the aftermarket business, which includes aircraft and components dismantling, maintenance, repair and reuse. Since 2022, Sumitomo Corporation has partnered with U.S.-based Werner Aero – a company specializing in the procurement of retired aircraft and the sale of used components – to jointly advance part-out operations, in which usable components are salvaged from decommissioned aircraft. At the same time, R&D efforts are underway to commercialize the recycling of components and materials that cannot be reused.

Ultimately, the Sumitomo Corporation Group aims to maintain its standing as a global leader in aircraft, engine and helicopter leasing, while contributing to the development and sustainability of global transport infrastructure. At the same time, the Group is committed to supporting the future of aviation across the entire aircraft lifecycle and driving the realization of a circular economy.