Shareholder Return Information

Shareholder Return Policy

Our shareholder return policy in the Medium-Term Management Plan 2026 and thereafter are as follows:

- Pay dividends and repurchase our shares in a flexible and agile manner with a total payout ratio of 40% or higher; and

- Further improve dividend stability and increase dividends in line with profit growth through progressive dividend payments*1.

- Dividends in FY2024 and FY2025 Profit attributable to owners of the parent in FY2024 was 561.9 billion yen, and we paid an annual dividend of 130 yen per share. The interim and year-end dividends for FY2024 were both 65 yen per share. Considering the full-year consolidated earnings forecast for FY2025 of 570.0 billion yen, we plan to increase the FY2025 dividend by 10 yen per share compared to the previous fiscal year to a total of 140 yen per share.

- Share repurchases in FY2024 and FY2025 On May 2, 2024, we decided to execute a share repurchase (from May 7 to July 19, 2024) up to 50.0 billion yen as a form of shareholder returns for FY2024, and the share repurchase was completed on June 17, 2024. In addition, on May 1, 2025, we decided to execute a share repurchase (from May 2, 2025 to March 31, 2026) of up to 80.0 billion yen, of which 20.0 billion yen will be allocated as additional shareholder returns for FY2024 and 60.0 billion yen as shareholder returns for FY2025.

*1 Dividends to be maintained or increased.

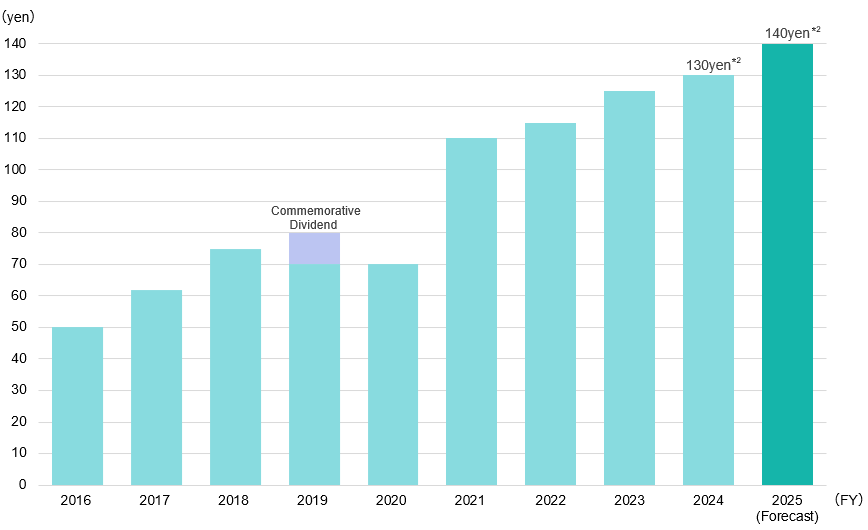

Dividend per Share

| For the years ended March 31 | Cash dividends per share (Total) | Interim | Year-end |

|---|---|---|---|

| FY2016 | 50yen | 25yen | 25yen |

| FY2017 | 62yen | 28yen | 34yen |

| FY2018 | 75yen | 37yen | 38yen |

| FY2019 | 80yen (ordinary didivend 70yen+ 100 anniversary commemorative dividend 10yen) |

45yen (ordinary dividend 35yen+ 100 anniversary commemorative dividend 10yen) |

35yen (ordinary dividend 35yen) |

| FY2020 | 70yen | 35yen | 35yen |

| FY2021 | 110yen | 45yen | 65yen |

| FY2022 | 115yen | 57.5yen | 57.5yen |

| FY2023 | 125yen | 62.5yen | 62.5yen |

| FY2024*2 | 130yen | 65yen | 65yen |

| FY2025 (Forecast)*2 | 140yen (Forecast) | - | - |

*2 For details, please see "Shareholder Return Policy" at the top of this page.

Progress of the Share Repurchases

| Period for repurchases | Total number of shares to be repurchased | Aggregate repurchases amount*3 |

|---|---|---|

| From Feb. 7, 2023 to Apr. 28, 2023 | 21,268,200 shares | 50.0 billion yen |

| From May 10, 2023 to Jun. 9, 2023 | 7,478,000 shares | 20.0 billion yen |

| From May 7, 2024 to Jun. 17, 2024 | 12,288,300 shares | 50.0 billion yen |

| From May 2, 2025 to May. 31, 2026 | 35,000,000 shares (maximum) | 80.0 billion yen (maximum) |

*3 Amounts of less than hundred million yen are rounded off.

Cancellation of Treasury Stock

| Cancellation period | Number of shares |

|---|---|

| Jun. 2, 2023 | 21,268,200 shares |

| Jul. 24, 2023 | 7,478,000 shares |

| Aug. 28, 2024 | 12,288,300 shares |