Overview of Impairment Losses

Impairment losses totaling approximately ¥310 billion were recognized primarily with regard to large-scale projects in the upstream mineral resources and energy field.

One subject of impairment loss was a tight oil development project in the Permian Basin, which is located in the U.S. state of Texas. The geographic layout of the region under development (shale layer) proved to be more complex than initially expected, with underground conditions varying greatly between different areas, even within the same stratum. Accordingly, the development of different drilling methods was necessary for each area, which has made it difficult to extract oil and gas efficiently. It was therefore determined that continuing development while guaranteeing profitability would be difficult, and we thus decided to sell the project together with our partner Devon Energy Corporation. We also revised long-term business plans for regions in which Sumitomo Corporation plans to maintain holdings. As a result, the Company recognized an impairment loss of ¥199.2 billion.

The Company has developed a track record in and acquired expertise related to such projects through its involvement in the Barnett and Marcellus shale gas development projects, in which we commenced participation in 2009 and 2010, respectively. Regardless, we succumbed to risks regarding tight oil excavation that we were unable to predict when we started participating in the Permian Basin project.

In regard to the iron ore mining project in the Serra Azul region of the Brazilian state of Minas Gerais, we determined the amount of investment in this project based on the value of expansion projects that were planned at the time of participation. However, these expansion projects were later delayed, and iron prices dropped. We were therefore forced to revise our long-term business plans, leading to the recognition of an impairment loss of ¥62.3 billion.

Elsewhere, the shale gas project in the United States, coal mining projects in Australia, and oil field interests in the North Sea were all impacted by falling resource prices, which led to the recording of impairment losses.

Impairment losses were also recorded in nonmineral resource businesses.

TBC Corporation, the operator of a tire business in the United States, had been suffering from poor performance for some time. This was largely due to a decline in the number of automobiles within the age range that TBC targets, a result of the drop in new automobile sales that followed the bankruptcy of Lehman Brothers in 2008, as well as the delays in this company's response to diversifying customer needs in its retail operations. While we attempted to address this situation by placing the reconstruction of TBC's retail operations as a top priority, the pace of recovery was not up to the speed called for by business plans. The Company was therefore forced to record an impairment loss of ¥21.9 billion.

Breakdown of Impairment Losses on Large-Scale Projects

| |

Project outline |

Amount of impact on profit for the year

attributable to owners of the parent |

Main reasons for impairment losses |

| Tight oil development project in the U.S. |

Tight oil and gas development and relevant businesses in the U.S. state of Texas |

−¥199.2 billion |

- Resolution to sell certain held assets

- Decline in crude oil prices

- Revision of long-term business plans

|

| Iron ore mining project in Brazil |

Iron mine development and related businesses in the Serra Azul region of the Brazilian state of Minas Gerais |

−¥62.3 billion |

- Decline in iron ore prices

- Revision of long-term business plans and future expansion plans

|

| Shale gas project in the U.S. |

Shale gas development and related businesses in the U.S. state of Pennsylvania |

−¥31.1 billion |

- Decline in crude oil and gas prices

- Revision of long-term business plans

|

| Coal mining projects in Australia |

Investments in coal mines in Australia |

−¥24.4 billion |

|

| Tire business in the U.S. |

Retail and wholesale of tires in the U.S. |

−¥21.9 billion |

- Revision of business plans

|

| Oil field interests in the North Sea |

Crude oil and natural gas development, production, and sales in the British and Norwegian zones of the North Sea |

−¥3.6 billion |

- Decline in crude oil prices

- Revision of long-term business plans

|

| Tax effect, etc. |

|

+¥32.3 billion |

|

| Total |

|

−¥310.3 billion |

|

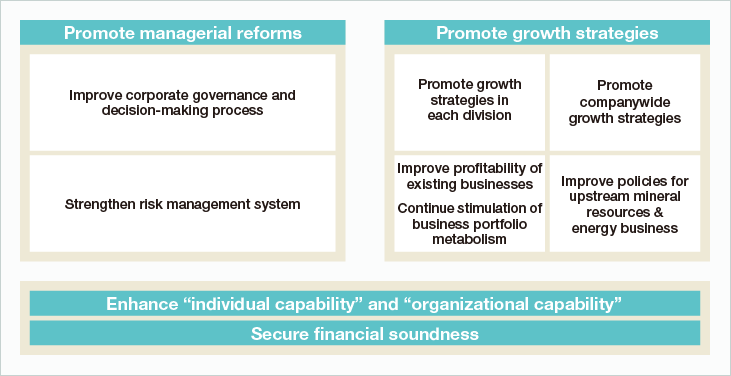

Proposals

The Company has received proposals from the Special Committee on Managerial Reform with regard to areas requiring improvement to increase corporate value.

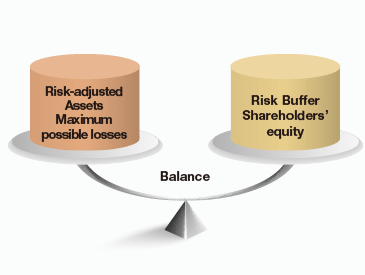

In fall 1998, ahead of its peers, Sumitomo Corporation introduced the Risk-adjusted Return Ratio* as an indicator of profitability, or the degree of return from a certain level of risk. This move enabled us to construct a business foundation capable of sustaining stable earnings and maintaining financial soundness even in severe economic environments. For large-scale investment projects, we had established a process through which investment decisions were made after sufficient discussion among the Loan and Investment Committee, Management Council, and Board of Directors. However, realizing the need to thoroughly investigate the causes of the recent impairment losses and utilize this information in future management decisions, we established the Special Committee on Managerial Reform within the Company in September 2014. An external consultant was then hired, and the committee set about conducting in-depth investigations and analyses of the reasons behind the impairment losses. Based on the findings, the committee discussed a wide range of improvement measures from a broad perspective with an eye toward improving corporate value. Proposals were then made to the Company with regard to the areas requiring improvement.

Special Committee on Managerial Reform

- • Established as a committee independent from the president in September 2014

- • Members: 7 executive officers

Approx. 20 members in total, including secretariats

- • Tasked with conducting in-depth investigations and analyses of projects recognizing impairment losses

- • Made proposals to the Board of Directors with regard to areas requiring improvement for increasing corporate value prior to the announcement of BBBO2017 in March 2015

Areas of improvement

The Group has identified areas requiring improvement and is implementing new strategies accordingly.

In consideration of the proposals of the Special Committee on Managerial Reform and reflections on past events, the Group has identified the following areas needing improvement.

- · Strengthening risk management for upstream mineral resources and energy businesses

- · Improving profitability of existing businesses

- · Steadily achieving profitability after implementing business investments

- · Exercising integrated corporate strength through cooperation between organizations

- · Regaining the balance between Core Risk Buffers and Risk-adjusted Assets and enhancing cash-generation capabilities

The new medium-term management plan BBBO2017 was established to realize improvements in these areas.

Policies to Be Continued

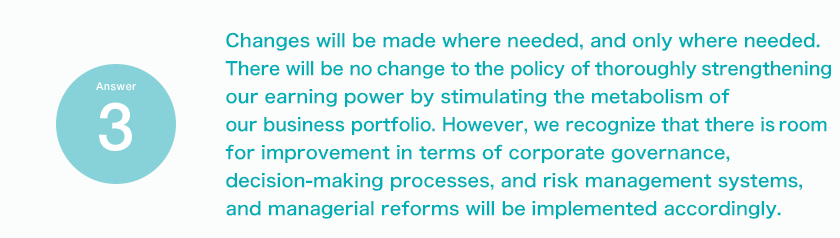

By working to stimulate the metabolism of our business portfolio, we have steadily strengthened the Group's earnings base.

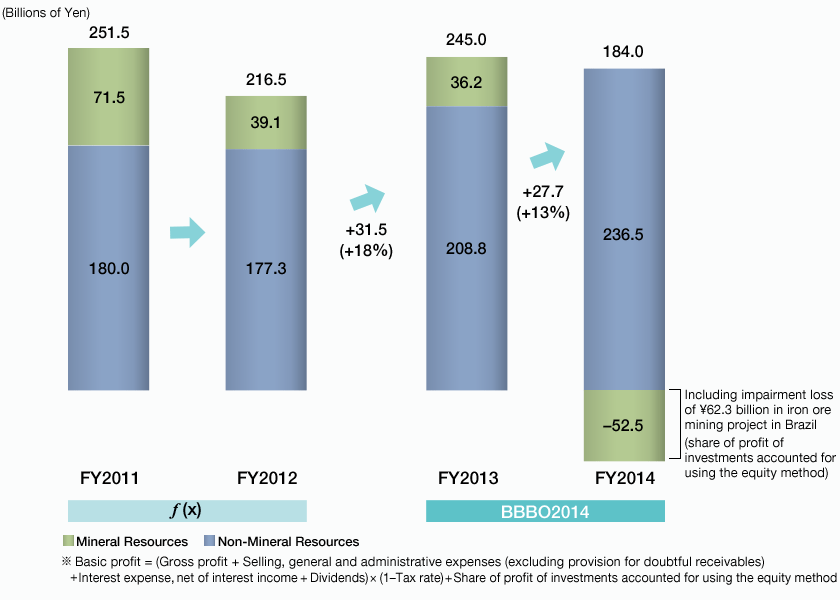

The “Be the Best, Be the One 2014” (BBBO2014) medium-term management plan was positioned as covering the first two years of our quest to become what we aim to be in 2019. Under this plan, we worked to thoroughly enhance the Group's earning power by stimulating the metabolism of our business portfolio through such means as making the existing earnings pillars even more robust, achieving greater value for existing investment projects, fostering and developing new pillars of earnings for the future, and replacing assets. As a result, basic profit for non-mineral resource businesses has continued to show annual growth rates of more than 10% since fiscal 2012, when basic profit of approximately ¥180.0 billion was posted. Specific contributors to this result include the growth of core businesses and earnings contributions from projects in which investment was recently commenced. Under BBBO2017, we will continue to push forward with measures to enhance earning power by stimulating the metabolism of our business portfolio.

Trend in Basic Profit*

Policies to Be Improved

While advancing managerial reforms, we will focus on cash flow management as a discipline for the promotion of our growth strategies.

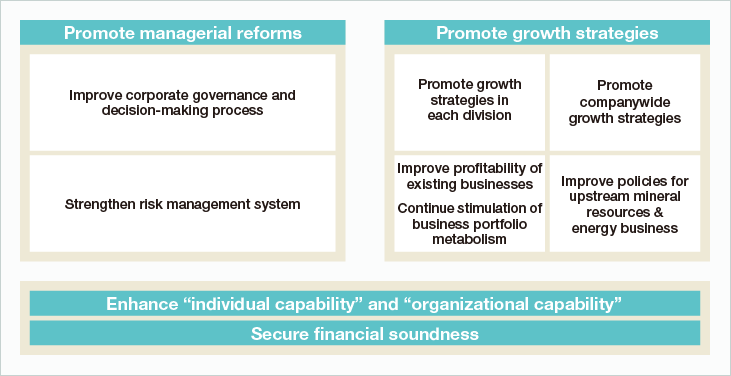

BBBO2017 is based on the theme of outlining a path to be walked as we unite to pursue improvements in necessary areas to become what we aim to be. The plan will therefore guide us as we advance managerial reforms and growth strategies.

In regard to managerial reforms, we will first endeavor to improve decision-making processes by establishing systems through which important decisions will be made after incorporating various opinions and conducting multifaceted and multistaged discussions.

The next step will be to reinforce supervisory functions for the Board of Directors.

We will then drastically overhaul and strengthen risk management systems.

Furthermore, we realize that securing financial soundness is essential to advancing managerial reforms and growth strategies, and we will set a discipline in growth strategies. Accordingly, we will keep investments and dividend payments within the scope of the cash flows generated by the Company, rather than becoming overly dependent on interest-bearing debt, to realize sustainable growth.

Overview of BBBO2017