Message from the President and CEO: To Our Stakeholders

To begin, I must report that we were forced to post an overall loss for fiscal 2014 after recognizing substantial impairment losses.

The Sumitomo Corporation Group places great importance on conducting business activities that earn the trust of society, as represented by the inclusion of the phrase “integrity and sound management” in the Management Principles. I realize these impairment losses will undoubtedly erode the trust of stakeholders that the Group has worked hard to earn over the years, and I am fully aware of the seriousness of this situation. We are fully devoted to regaining any trust we may have lost by implementing managerial reforms and measures to improve profitability and performance in order to return the Group to a growth track. I would like to ask for your continued support and understanding as we undertake this endeavor.

Be the Best,Be the One

Be the Best,Be the One

2017(BBBO2017) Shareholder Returns

Shareholder Returns Sumitomo's Business Philosophy and

Sumitomo's Business Philosophy and

the Company's Long-Term Vision In Closing

In Closing

Be the Best, Be the One 2017

(BBBO2017)

To be launched in fiscal 2015, the new medium-term management plan-Be the Best, Be the One 2017 (BBBO2017)-calls for us to faithfully execute managerial reforms and growth strategies.

Managerial Reforms

The first step of our managerial reforms will be to improve decision-making processes and strengthen risk management systems. In regard to decision-making processes, the Management Council will be positioned as the highest authority on business execution matters, thereby creating a system through which important decisions will be made following more multifaceted discussions incorporating a wider range of opinions. Reforms will be extended to the Board of Directors as well; we have strengthened supervisory functions for management execution and created a system for discussion that places greater weight on formulating Companywide strategies and basic policies.

As for risk management systems, we have set up a process to deliberate large-scale investments at multiple stages and different levels. Through this process, investment candidates will be discussed several times by the Investment Committee at both the business unit level and the Companywide level as well as during the stages of examining and conducting investments. In this way, we hope to more deeply investigate large-scale investment candidates from various perspectives based on their business feasibility and relation to the strategies of associated divisions.

In addition, we will steadily implement other managerial reforms, such as setting stricter investment evaluation standards and revising investment execution frameworks. By creating and displaying results through these reforms, we aim to regain lost trust. At the same time, we will pursue improvements in overall operational efficiency through such means as delegating authority in a manner that prevents these managerial reforms from adversely impacting business-by creating management redundancies or slowing decision-making speed, for example.

Managerial Reforms and Growth Strategies

Please refer to the Special Feature entitled “Medium-Term Management Plans –Results of BBBO2014 and Overview of BBBO2017,” for details on BBBO2017.

Growth Strategies

Under BBBO2017, we will push forward with growth strategies in the metal products, transportation, and media businesses, all areas of strength for the Company. Moreover, the three areas of automobiles, infrastructure, and lifestyle and information services will be positioned as targets of Companywide, crossorganizational collaboration in consideration of projected medium-to-long-term macroeconomic trends. Furthermore, we have identified high-potential industrial fields and regions and will continue strengthening efforts to cultivate businesses in these areas on a Companywide basis. Such strategic industrial focuses include energy-related businesses, retail businesses in Asia, and food and agriculture-related businesses, while Brazil, India, Myanmar, Turkey, and sub-Saharan Africa have been identified as strategic regional focuses.

The majority of the impairment losses recorded in fiscal 2014 can be attributed to the mineral resources and energy businesses. For the time being, we intend to devote our attention to starting up large-scale projects presently in the preparation phase, such as the Ambatovy nickel project, and reducing the costs of currently operating projects to improve the quality of our asset portfolio. Learning from our experience with these impairment losses, we have set upper limits for investments in individual projects and otherwise strengthened risk management systems. We have also established a specialist organization comprised of individuals with superior market analysis and technological evaluation capabilities assembled from both inside and outside of the Company.

We believe demand in the mineral resources and energy field will increase in the future as a result of medium-to-long-term growth in the global population as well as in the economies of emerging countries. Upstream mineral resources and energy businesses will still be viewed as an area of operations crucial to the future growth of the Sumitomo Corporation Group, and we therefore plan to continue operating these businesses going forward, albeit under newly reconstructed systems.

Social Infrastructure, Retail Businesses in Asia

Please refer to the Special Feature entitled “Initiatives under BBBO2017,” for details on BBBO2017.

Enhancement of Individual Capability and Organizational Capability

As an integrated trading company, the fundamental essence of our operations is to create new businesses, and this is a task that is spearheaded by our human resources. For this reason, human resource development has been designated as a priority of utmost importance, and we have continued to provide our employees with opportunities to gain a diverse range of experience immediately upon joining the Company. In this manner, we have been working to enhance the capabilities of Sumitomo Corporation's human resources.

The human resources we have developed through these efforts are establishing various businesses for the Company. I suspect that our employees will be quite capable of creating new value by communicating with local customers and consumers in emerging countries, which are expected to continue developing on the back of brisk economic activity, and thereby form an understanding of their needs.

Securing of Financial Soundness

A top priority of BBBO2017 is to regain the balance between Core Risk Buffers and Risk-adjusted Assets. The impairment losses recognized in fiscal 2014 resulted in risk assets growing to the point that they exceeded the extent of the Core Risk Buffers, destroying this balance that has underpinned our management. While this upset will not seriously impede the management of the Group, there is no doubt that we must restore this balance at the earliest date possible.

At the same time, management is placing a greater emphasis on cash flows to help ensure sustainable growth. The gross balance of interest-bearing debt on the Company's consolidated statement of financial position is approximately \4.0 trillion. Characterized by low interest rates, the current financial climate in Japan is conducive to a management approach that utilizes borrowings to fund investments and exercise leverage. However, for Sumitomo Corporation to realize sustainable growth, it is crucial to establish a financial constitution that is not overly dependent on interest-bearing debt. We therefore aim to limit investments and shareholder returns to within the scope of the cash generated by the Company through operating cash flows and asset replacement. Accordingly, BBBO2017 contains the basic policy of maintaining a positive free cash flow in terms of the threeyear, post-dividend total.

Shareholder Returns

Sumitomo Corporation's basic policy is to provide shareholders with stable dividends over the long term, and we also aim to raise per share dividend payments by pursuing profit growth in the medium-to-long term.

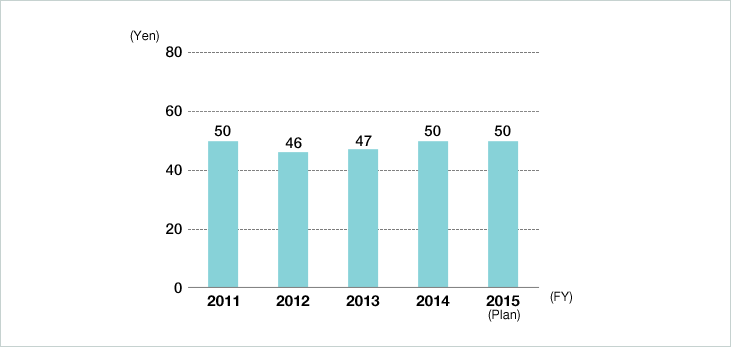

We are highly committed to achieving the targets of BBBO2017 and have thus set ¥50 per share as the lower limit for dividend payments over the period of the plan. Dividend amounts for each fiscal year will be decided based on considerations of basic profit and cash flow levels and with a consolidated dividend payout ratio of 25% as our target. In fiscal 2015, we intend to issue dividend payments of \50 per share.

Dividends per share

Sumitomo's Business Philosophy and the Company's Long-Term Vision

In 2019, we will celebrate the centennial anniversary of the foundation of the Osaka North Harbour Company Limited, the predecessor of Sumitomo Corporation. I hope to make the Sumitomo Corporation Group into a conglomerate that can thrive stably and continuously for another 50 years, 100 years, and on without end. By this, I do not refer to simply keeping the Company profitable; rather, I feel it is important for us to continue growing by adhering to the Management Principles, which are based on Sumitomo's business philosophy, the principal reason behind Sumitomo's ability to survive for 400 years.

One of the core concepts in Sumitomo's business philosophy is embodied in the phrase “Benefit for self and others, private and public interests are one and the same.” This phrase is based on the belief that Sumitomo's business does not exist only for the sake of Sumitomo, but should be an endeavor that contributes to the greater society. Likewise, I feel all Sumitomo Corporation Group employees should fully exert themselves to faithfully serve the stakeholders affected by their specific area of business. If all employees act in this manner, I am confident that Sumitomo Corporation will become a better company as a result.

Sumitomo's business philosophy also includes the virtue of integrity and sound management, a core business value. Sumitomo founder Masatomo Sumitomo penned this philosophy in a letter to a family member written in his later years, and this philosophy has continued to be handed down from generation to generation over the 400-year history of the Sumitomo Group. I believe Sumitomo's business philosophy embodies the distinctive business approach of Sumitomo Corporation. Staying true to this approach, we will push forward with managerial reforms and achieve our earnings targets with the aim of regaining any trust we may have lost with our stakeholders.

If we look to the past, we will see the 400-year history of Sumitomo. If we look to the future, we will see ourselves on the path toward realizing “What We Aim to Be.” We have continued to value trust throughout our history, and this will not change going forward, a fact that all members of the Sumitomo Corporation Group, myself included, should once again take to heart.

Please refer to “Our History”.

In Closing

In formulating the new medium-term management plan, Sumitomo Corporation's management engaged in thorough discussions with regard to measures that must be taken for the Company to regain lost trust. It was determined that the shortest path was to regain trust in the same way that we have earned it over our long history: by tenaciously pushing forward with managerial reforms and strengthening earning power, followed by displaying the results of these efforts to our stakeholders.

Devoted to winning back the trust of our stakeholders as soon as possible, everyone at the Sumitomo Corporation Group is united in their commitment to advancing BBBO2017 and working to return quickly to a growth track. I humbly ask for your continued understanding and support of our efforts.

August 2015

Kuniharu Nakamura

President and CEO